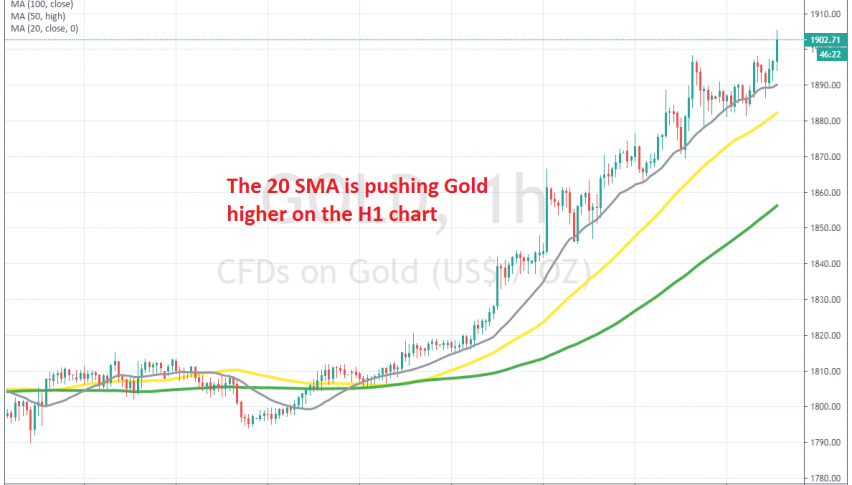

Nothing Seems to Stop the Gold Rally

Gold buyer are not waiting for a pullback, but jumping in as soon as the 20 SMA catches up

GOLD has been bullish for two years, as the sentiment turned negative due to the US-China trade war, which kept safe havens well bid throughout this time. Gold in particular turned really bullish, surging higher for around two years, but the biggest gains came after the coronavirus pandemic broke out.

Gold has climbed around $450 since the middle of March and it continues to surge higher, as days go by. Many analysts are wandering where the bullish momentum will end, but it doesn’t seem to be ending any time soon, with another big round level being taken out, as the $1,900 level gets broken today.

This week in particular has been extremely bullish. The 20 SMA (grey) has turned into support, which shows that the buying pressure is quite strong in Gold. Traders are not waiting for a pullback down, instead they are jumping in as soon as the 20 SMA catches up on the H1 chart. We will try to get long on Gold, once the 20 SMA catches up again with the price.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account