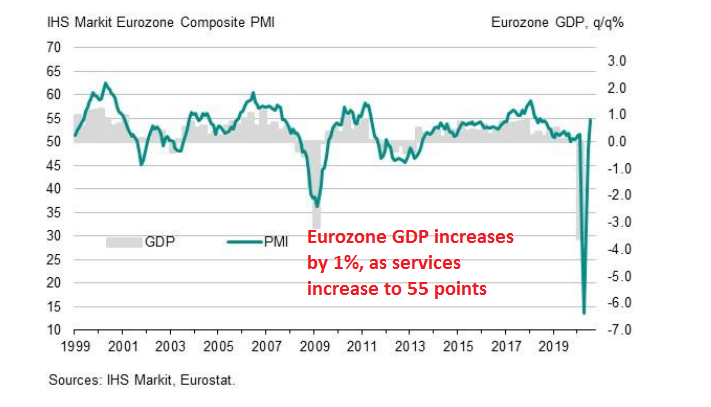

Services Jump in Europe After the Reopening

Services surged during June in Eurozone and the UK

Services were the most damaged sector during the lock-down months due to coronavirus. Manufacturing and the industrial production also fell in deep contraction, but the services tumbled the most. After all, if people get locked in, the service sector will suffer the most, apart from take-aways and supermarkets. But, it seems like services are surging all over Europe, as the economy reopens. In fact, this jump takes services higher that the pre-coronavirus levels.

Eurozone Services PMI Report, Released by Markit – 24 July 2020

- July flash services PMI 55.1 vs 51.0 expected

- June services 48.3

- Manufacturing PMI 51.1 vs 50.1 expected

- June manufacturing 47.4

- Composite PMI 54.8 vs 51.1 expected

- June Composite 48.5

Solid beats across the board as preempted by the French and German readings earlier. Both the services and composite prints are their highest in over 25 months. Even the manufacturing beat is the highest in 19 months. This just reaffirms that euro area business activity returns to growth in July as lock-down restrictions are eased and conditions are faring better relative to May to June. But as mentioned earlier, the real challenge will be to see how this recovery can stand as labour market conditions start to move towards standing on its own two feet later this year.

“Companies across the euro area reported an encouraging start to the third quarter, with output growing at the fastest rate for just over two years in July as lockdowns continued to ease and economies reopened. Demand also showed signs of reviving, helping curb the pace of job losses.

“The data add to signs that the economy should see a strong rebound after the unprecedented collapse in the second quarter.

“However, while the survey’s output measures hint at an initial v-shaped recovery, other indicators such as backlogs of work and employment warn of downside risks to the outlook.

“The concern is that the recovery could falter after this initial revival. Firms continue to reduce headcounts to a worrying degree, with many worried that underlying demand is insufficient to sustain the recent improvement in output. Demand needs to continue to recover in coming months, but the fear is that increased unemployment and damaged balance sheets, plus the need for ongoing social distancing, are likely to hamper the recovery.”

UK Services PMI Report

- July flash services PMI 56.6 vs 51.5 expected

- June flash services PMI 47.7

- Manufacturing PMI 53.6 vs 52.0 expected

- June manufacturing PMI 50.1

- Composite PMI 57.1 vs 51.7 expected

- June composite PMI 47.7

The easing of lockdown measures has spurred a solid upturn in UK business activity, but once again this just reaffirms that conditions here are much better than they were compared to the May to June period. Still, it is a positive takeaway nonetheless.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account