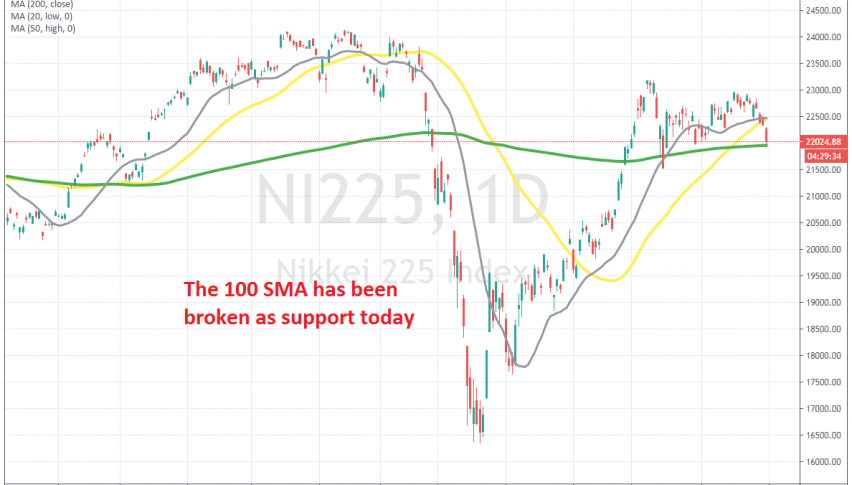

Tried A Long Trade in Nikkei At the 100 SMA, But the Decline Doesn’t Seem to End

Nikkei crashed lower overnight, as the situation in Japan got gloomy

•

Last updated: Friday, July 31, 2020

The Nikkei is ending the week on a softer note, as fears surrounding domestic and global growth are still evident amid the escalating virus situation in Japan and the US. The stronger yen also weighed on exporters, as we see USD/JPY fall to 104.00 level.

On the week, the Nikkei is seen down by over 4%, more than any other major index. Elsewhere, the Hang Seng is down 0.3% while the Shanghai Composite is keeping higher by 0.2% in a bit of a mixed session for Chinese equities today. China’s economy is well and running, so there’s no reason for Chinese stocks to be bearish.

The broader picture paints a more cautious and defensive risk tone in Asian trading this week. For today, US futures are keeping calmer near flat levels but Nasdaq futures are higher after earnings beats from key tech giants overnight. But the Nuikkei225 is still slipping lower.

We decided to go long yesterday at the 100 SMA (green) on the daily chart, since it was providing support on the daily chart. But that moving average has been broken today as the sentiment has deteriorated further for this index and it fell around 400 points lower overnight.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.