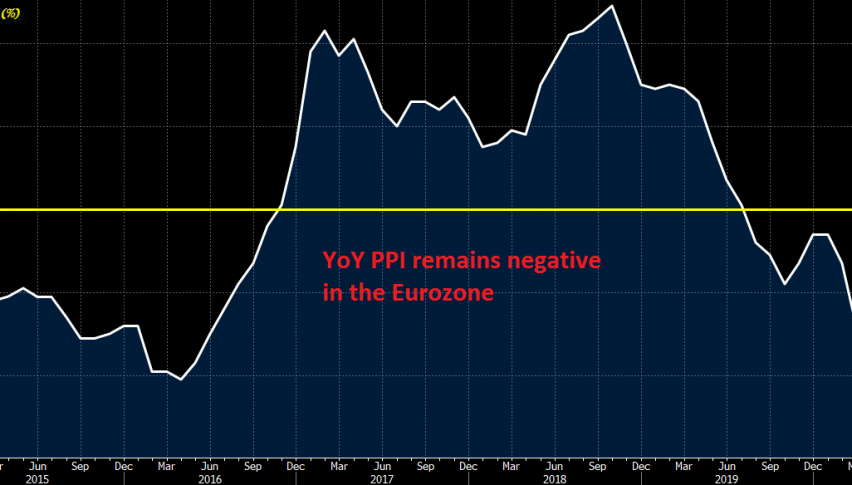

Eurozone PPI Jumped in June, But Remains Negative YoY

Eurozone PPI posted a nice jump in June, as Oil prices rose back up

The PPI (producer price index) report from the Eurozone for June was released a while ago, posting a nice jump for June. PPI inflation turned massively negative from February until May, as the Oil prices kept tumbling lower due to the coronavirus outbreak in China and then in the West, which turned improt prices negative. But, it seems like the PPI has jumped in June, as Oil prices increased again.

Eurozone June PPI Report Released by Eurostat – 4 August 2020

- June PPI MoM +0.7% vs +0.6% expected

- MAy 0.6%

- June PPI YoY -3.7% vs -3.8% expected

- May PPI YoY -5.0%

Producer prices improved a little once again in June but are still largely subdued relative to a year ago. The data here is a proxy for inflation pressures in any case and is a lagging indicator, so not much else to really gather from the release. EUR/USD keeps a little firmer still just under the 1.1800 handle as the battle around key near-term levels continues on the session. ECB’s Lane was also feeling slightly more positive today, but there is still plenty of room for improvement in markets.

Comments by ECB chief economist, Philip Lane

- ECB is committed to providing stimulus needed to support the economic recovery

- Overall PEPP envelope is a core determinant of ECB’s policy stance

- There is some rebound in economic activity

- But level of economic slack remains extraordinarily high

- The outlook remains highly uncertain

- Inflation outlook plays the central role in determining appropriate policy stance

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account