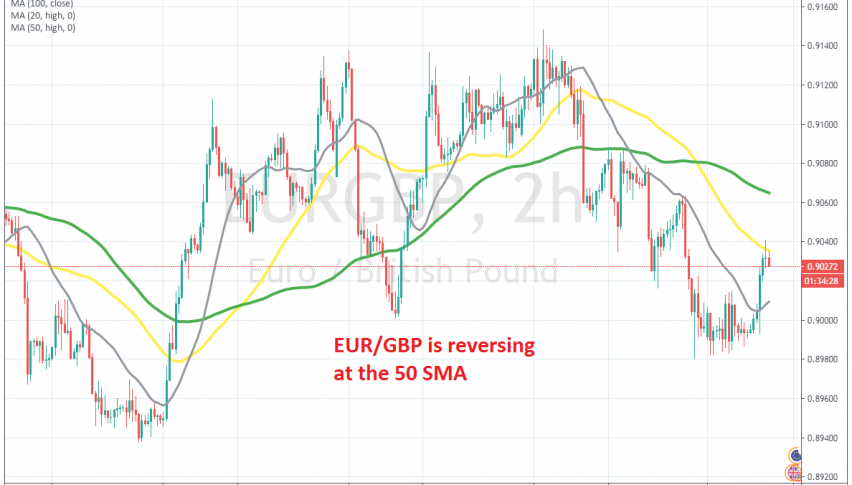

The Pullback Higher Should Be Over for EUR/GBP

EUR/GBP retraced higher earlier today, but a bearish reversing chart setup has formed now

The Euro has turned quite bullish since May, after the comments from EU leaders about the coronavirus recovery fund worth around EUR1.35 billion. That improved the sentiment in the Eurozone, as well as globally, especially for the Euro which has been bullish since then.

EUR/USD has been surging higher, climbing around 10 cents from May until last week. GBP/USD has also been surging higher, but the climb in the Euro has been stronger, which was keeping this pair bullish. Although, that lasted until last week, when it reversed back down.

EUR/GBP has lost around 170 pips from the top. The 20 SMA has been providing resistance on the H2 chart during the decline, pushing this pair lower. Today though, buyers managed to push above the 20 SMA, but it seems like the 50 SMA (yellow) is acting as resistance now.

We decided to open a sell signal here, since the retrace up is complete on the H2 chart, the 50 SMA is acting as resistance, while the previous candlestick closed as a doji, which is a bullish reversing signal. All technicals are pointing down, so we went short below the 50 SMA, now the reversal is already starting, as the current candlestick shows.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account