UK GDP Dives in Q2, But Makes A Strong Bounce in June

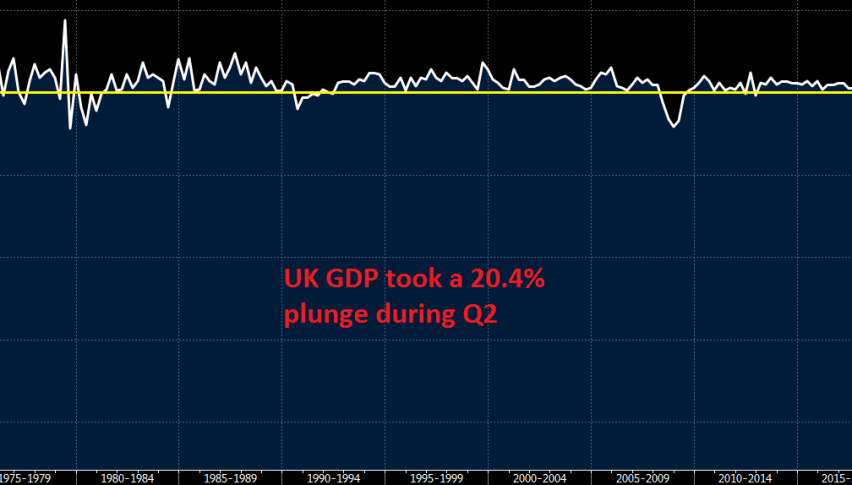

The UK economy was already pretty weak last year, due to the Brexit process, as well as from the weakening global economy. But, the coronavirus lock-down gave it a final blow, sending it diving lower, by more than 20% in Q2. Although, the Q2 is history now and the GPD number for June is showing a decent rebound, although it’s not as strong as in other countries. Below is the Q2 and the June GDP reports from the UK:

UK Q2 Prelim GDP Report

- Q2 preliminary GDP -20.4% vs -20.7% QoQ expected

- Q1 preliminary GDP -2.2%

- GDP YoY -21.7% vs -22.3% expected

- Prior GDP YoY -1.7%

- Private consumption Q2 -23.1% vs -18.9% expected

- Private consumption Q1 -2.9%

- Government spending Q2 -14.0% vs +0.7% expected

- Government spending Q1 -4.1%

- Exports Q2 -22.3% vs -21.5% expected

- Exports Q1 Prior -13.5%

- Imports Q2 -23.4% vs -23.9% expected

- Imports Q2 -9.4%

- Total business investment Q2 -31.4% vs -30.0% expected

- Total business investment Q1 -0.3%

UK June Prelim GDP Report

- June monthly GDP +8.7% vs +8.0% expected

- May GDP +1.8%; revised to +2.4%

- Index of services +7.7% vs +8.0% expected

- Prior index of services +0.9%; revised to +1.5%

Slight delay in the release by the source. The positive takeaway here is that the UK economy improved further in June but ONS notes that overall economic activity in the month is still a sixth below its level in February i.e. pre-virus impact. There isn’t much else to gather from the report here as it just reaffirms a modest rebound since bottoming out in April but the outlook still remains uncertain moving forward.

- Manufacturing production +11.0% vs +10.0% m/m expected

- Prior +8.4%

- Manufacturing production -14.6% vs -15.0% y/y expected

- Prior -22.8%

- Industrial production +8.7% vs +9.0% m/m expected

- Prior +6.0%

- Industrial production -12.5% vs -13.1% y/y expected

- Prior -20.0%

- Construction output +23.5% vs +15.0% m/m expected

- Prior +8.2%

- Construction output -24.8% vs -29.5% y/y expected

- Prior -39.7%