US Inflation Remained High Again in July

US inflation turned positive in June after 3 negative months since March

Inflation turned negative in the US during March, April and May, declining by 0.4%,0.8% and 0.1% respectively, as consumer demand declined during those months. But, in June we saw a reversal and a 0.6% bounce for headline CPI (consumer price index) and by 0.2% for the core CPI. Although, headline CPI was expected to cool off to 0.3% in June, while core CPI was expected to remain unchanged at 0.2%. But, they both came at 0.6%, which is a positive thing when the uncertainly remains high.

US July 2020 CPI Inflation Report

- July CPI +0.6% vs +0.3% expected

- June was +0.6%

- Core CPI, ex food and energy +0.6% vs +0.2% expected

- CPI YoY +1.0% vs +0.7% expected

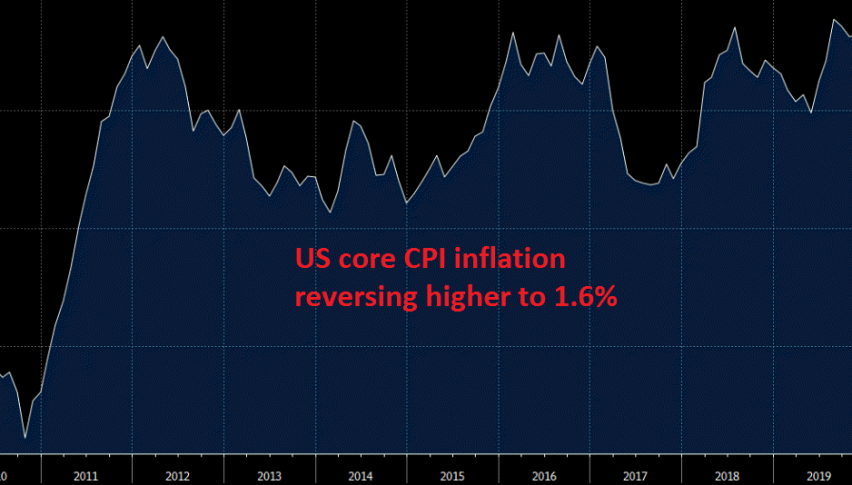

- Core CPI YoY, ex food and energy +1.6% vs +1.1% expected

Treasury yields are at the highs of the day on this. US 5-year yields rose to 0.307% from 0.295%. The USD should have increased, but it declined after that report, with EUR/USD jumping 30 pips higher. Although, EUR/USD is slowly retreating lower now.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account