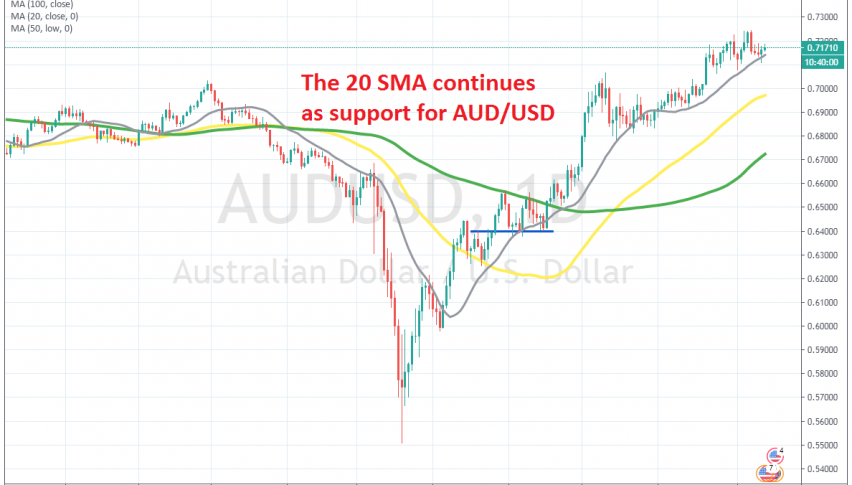

The 20 Daily SMA Is Keeping AUD/USD Bullish

AUD/USD slipped below the 20 SMA yesterday, but moved back above it

This has been quite a roller-coaster year for most assets and especially AUD/USD . This forex pair dived the most during the crash of the Q1, as panic sent commodity currencies crashing lower, while it seems to be the first to be heading the recovery since the crash stopped by the middle of March.

During the decline, the 20 SMA (grey) was providing resistance for this pair, pushing the price lower. It did so in early March and it provided resistance on April again, when the price was reversing higher. But, the trend eventually turned quite bullish and the price moved above the 20 SMA.

The 50 SMA turned into support at first at the beginning of April, then the 20 SMA took things in its hands and has been providing support since then. The price has pierced the 20 SMA a few times, but hasn’t broken it, since it has returned above it pretty quickly.

Yesterday we saw the price slip below this moving average again, but it returned above it and now the bullish trend seems intact again. So, bullish is the way to go in this pair, until the price clearly moves blow the 20 daily SMA. When that happens, the 20 SMA will likely turn into resistance, but until then, the buyers remain in charge.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account