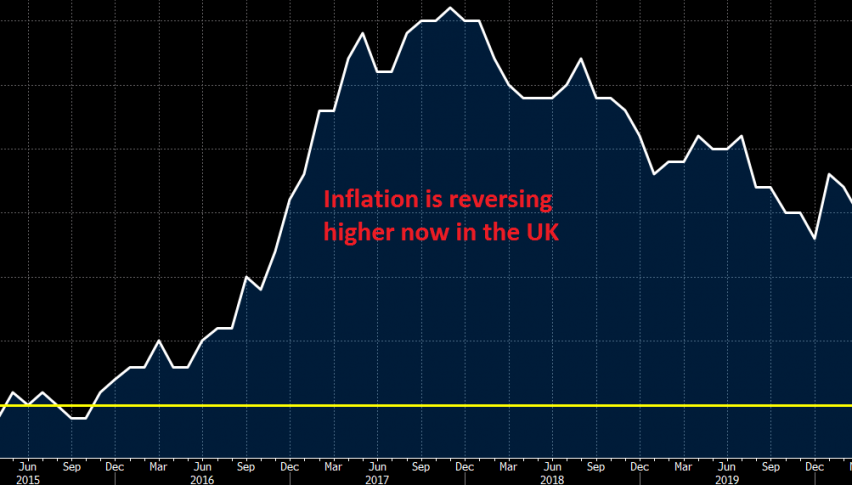

UK Inflation Jumped in July, Leaving Deflation Fears Behind

UK inflation reversed higher in July

•

Last updated: Wednesday, August 19, 2020

Inflation had been declining in the UK since early 2008, when it stood at above 3%. In Q2 of this year CPI (consumer price index) fell further to just 5% YoY. But inflation jumped higher in July to 1%, while the core CPI increased from 1.4% top 1.8%, while expectations were for another decline to 1.3%. Below is the UK CPI report:

CPI Report Released by ONS – 19 August 2020

- July CPI YoY +1.0% vs +0.6% expected

- June CPI stood at+0.6%

- Core CPI YoY +1.8% vs +1.2% expected

- Prior core CPI YoY+1.4%

Slight delay in the release by the source. Those are solid beat on inflation figures and from the headline it will help to alleviate some pressure off the BOE and buy them more time with the current wait-and-see approach. ONS notes that rising prices in clothing, petrol, households goods were among the contributors but the largest rise came from recreation and culture (+0.3% in HICP terms).

This will at least keep the pound more steady, or at least not become a reason for markets to become more anxious about the BOE factoring in negative rates in the near future. No doubt headline inflation is still subdued, but at least it has been trending a little higher in the past two months so policymakers can allude to that to wait for more data. GBP/USD continues to keep higher at 1.3260 currently, with the dollar staying weaker across the board as we look to get the session underway.

Some other details on the day as producer price and retail price figures are released:

- PPI output +0.3% vs +0.2% MoM expected

- PPI output -0.9% vs -0.9% YoY expected

- PPI input +1.8% vs +1.1% MoM expected

- PPI input -5.7% vs -6.1% YoY expected

- RPI +0.5% vs +0.1% MoM expected

- RPI +1.6% vs +1.2% YoY expected

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.