Mixed Numbers, Showing Weakness in US Economic Rebound

US MBA mortgage applications declined last week, but home buying increased

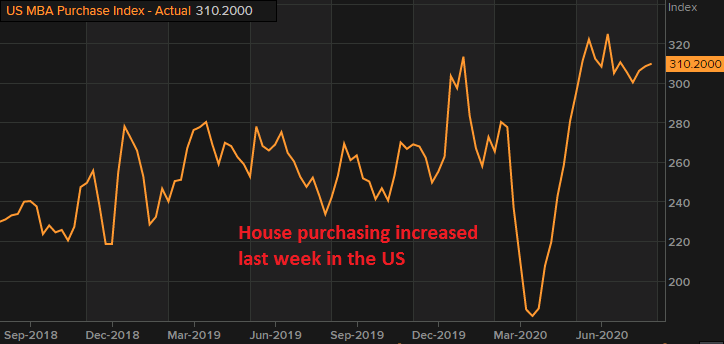

At first, when the lock-downs started, everyone was hoping for a quick rebound and a V-shape recovery, from the crash during the lock-downs. But as the lock-downs were extended from two weeks to two months, those hopes were starting to wear off. After the reopening, the rebound looked promising all over the world, but now not so much, as the economic indicators show weakness. After the reversal lower in US CB consumer sentiment on Tuesday, the mortgage applications showed a cool off as well, but the report inside is not as bad, so everything is mixed right now.

US MBA Mortgage Applications w.e. 21 August

- MBA mortgage applications w.e. 21 August -6.5% vs -3.3% prior

- Prior mortgage applications -3.3%

- Market index 770.6 vs 824.5 prior

- Purchase index 310.2 vs 308.9 prior

- Refinancing index 3,423.0 vs 3,809.7 prior

- 30-year mortgage rate 3.11% vs 3.13% prior

The headline shows a drop in mortgage activity but that is largely due to a slump in refinancing, as purchases continue to keep more steady and actually increased last week. That once again highlights the robustness of the housing sector in dealing with the fallout from the virus outbreak for the most part despite some cracks showing up in other parts of the economy, as evident by the drop in consumer confidence yesterday.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account