US Dollar Dips After Some Gains as Fed Shifts Strategy

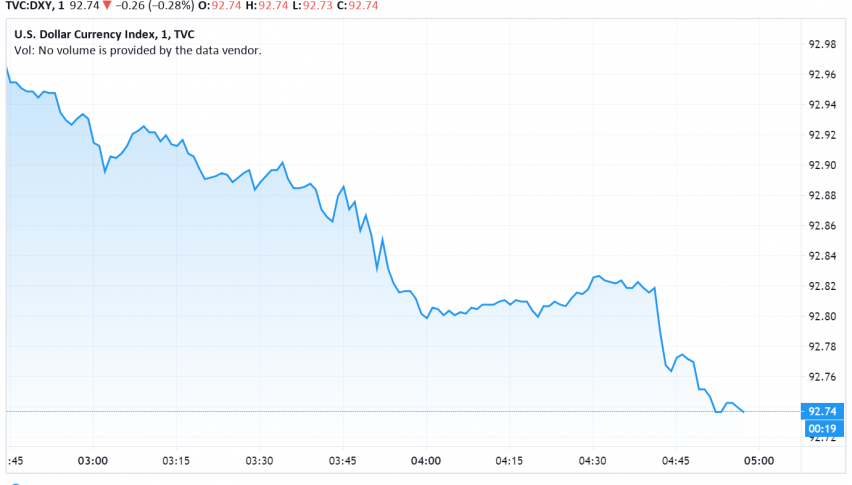

The US dollar has dipped after regained some of its strength a day after the Jackson Hole symposium where the Fed chair announced new measures to boost employment and have more tolerance for higher levels of inflation. At the time of writing, the US dollar index DXY is trading around 92.74.

On Thursday, Powell stated that the Fed will aim for maintaining inflation at an average level of 2%, allowing for periods of low inflation to be managed by efforts to lift it above 2% temporarily. This marks a distinct shift in the US central bank’s approach, making it focus more on driving economic growth instead of controlling inflation.

While the US dollar initially fell against its major peers following the announcement, it turned around and gained after US Treasury yields surged to multi-month highs. The benchmark 10-year US Treasury yield rose to 0.77%, the highest level since mid-June.

Bond yields had been weakening since the FOMC meeting back in June over worsening economic outlook for the US. This sentiment also weighed on the dollar and had sent it weaker after it had initially rallied as a safe haven currency when the pandemic began in March.