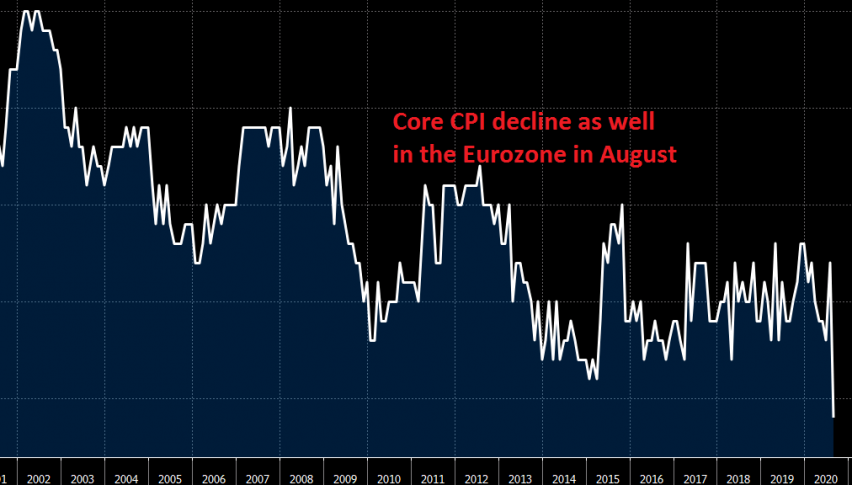

Eurozone Inflation Turns Lower Again in August

The Eurozone CPI declined by 0.2% this month

The Eurozone economy took a major hit during the lock-downs, due to coronavirus, as did all other economies around the globe. The Eurozone economy was already in difficulty before the covid, but during Q2 we saw a major contraction like never before.

Inflation cooled off considerably, which headline CPI (consumer price index) falling to 0.1% in May. Although, it started recovering in June and July, increasing to 0.4%. But, today’s report showed that CPI fell into negative territory this month at -0.2% for the first time in a long period. Nonetheless, EUR/USD keeps grinding higher due to the weakness in the USD.

Eurozone GDP Report Released by Eurostat – 1 September 2020

- August preliminary CPI YoY -0.2% vs +0.2% expected

- July CPI YoY stood at +0.4%

- Core CPI YoY +0.4% vs +0.8% expected

- August core CPI +1.2%

That is a considerable miss on inflation estimates and certainly isn’t an encouraging sign. The deflationary effects of the pandemic is truly being felt right now across the euro area and this is a development to watch closely in the coming months.

Eurozone July Unemployment Rate

- July unemployment rate 7.9% vs 8.0% expected

- June unemployment rate stood at 7.8%

The jobless rate in the region ticks higher a little but again the true nature of underlying labour market conditions is still heavily masked by government furlough programs at the moment. So, it is tough to draw much conclusions from the data here for now.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account