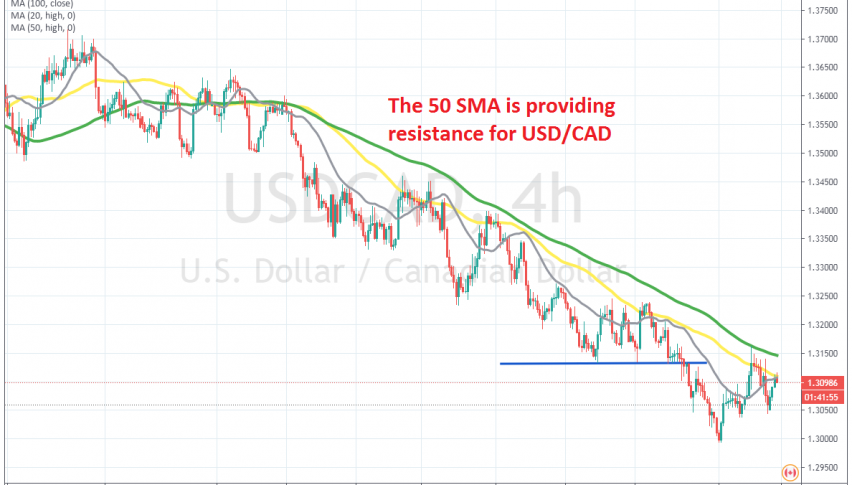

Selling the Retrace in the USD/CAD, as MAs Continue to Keep it Bearish

USD/CAD found resistance at the 20 SMA today and is now reversing lower

Since March, the USD/CAD has been on a bearish trend, which is still going, and there is no end in sight. This forex pair broke below the big round level at 1.30, although the quick reversal from there was a sign that buyers have not capitulated yet.

But, moving averages continue to keep this pair bearish in all time-frames, as Crude Oil has remained bullish so far. The price moved below moving averages on the daily chart, and the 20 SMA (gray) has been pushing the price lower on that time-frame, since May. On the H4 chart, it has been the 50 SMA (yellow) and the 100 SMA (green) which have been providing resistance.

Late last week, the 100 SMA stopped its jump from below 1.30, at 1.3160, reversing the USD/CAD lower. Today it is the 50 SMA which is providing resistance on this time-frame, after the 75 pip climb. We decided to open a sell forex signal, since the H4 chart again points to a bearish reversal from here, so let’s hope that sellers won’t take too long to push this price lower.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account