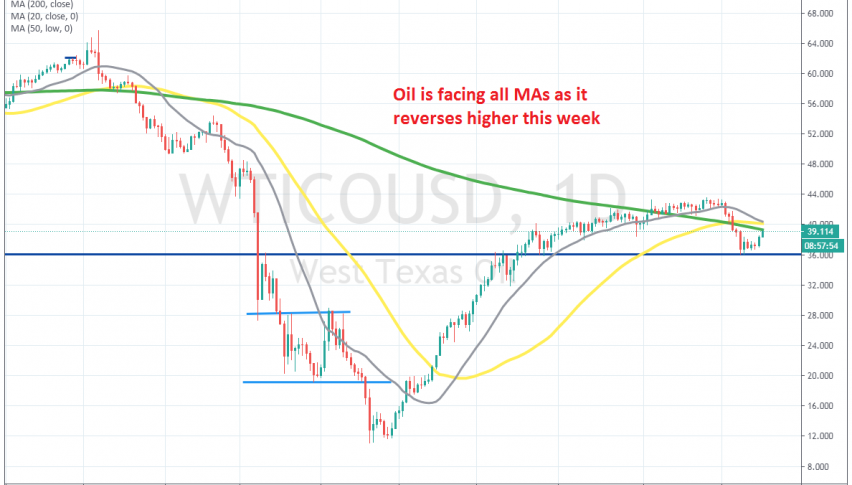

Crude Oil facing the 200 SMA After Reversing From $36

Crude Oil is now heading for $40, where it might turn bearish again

Crude Oil has been quite bullish since reversing from around -$37 in April, after the US Oil industry survived the glitch in April, when Saudis threw a lot of Oil reserves they had, leaving no storage room for US producers. But, that’s history now and Oil has been bullish since then.

US WTI crude Oil climbed around $80. to $43.50 from April until the end of August, gaining strength from the USD weakness as well. But, the USD decline stalled this month and crude Oil started to retreat lower during the first two week, taking the price $7.50 lower to $36.

That level has been providing support and resistance before, so it stopped the decline again in Oil and sellers couldn’t push below it for several days. Sellers eventually gave up and the price started reversing higher this week. Buyers have pushed above 1.39 but are facing all moving averages now. The draw-down from the API also helped in this reversal higher.

The 200 SMA (green) is standing right here at around $39, while the 20 SMA (grey) and the 50 SMA (yellow) are standing at $40, so they will offer some resistance, since that is a big round level as well. We will see, if sellers hesitate at $40 and a bearish reversing candlestick forms, then we might open a sell forex signal. But, let’s wait and see when the price gets up there.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account