Booked Profit After Buying the Pullback in Crude Oil

Crude oil has been bullish for several months, with US WTI Oil increasing around $ 80 from the middle of April. But after trading at around $ 43 for weeks and failing to push above $ 43.50, buyers eventually gave up and the first two weeks of September were quite bearish for oil.

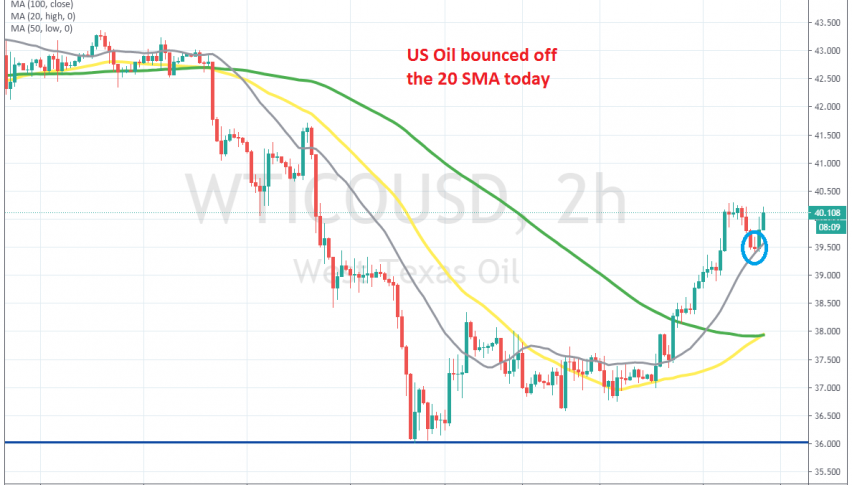

The price retreated lower earlier this month, and US Oil lost around 7.5 cents, falling to the $ 36 level, which has worked as both support and resistance before. The decline stopped here, and oil bounced back up above $ 40 earlier this week, which was a sign that buyers were not done yet.

Yesterday, we saw another pullback lower, but sellers were having difficulties at the 20 SMA (gray) on the H2 chart, and the price formed a doji there, which is a bullish reversing signal. So we decided to open a buy forex signal, with a stop below the 20 SMA. The price bounced during the night, so I woke up today to find that this forex trade had closed in profit, as oil bounced back up from the 20 SMA. Now, let’s prepare for the next trade.