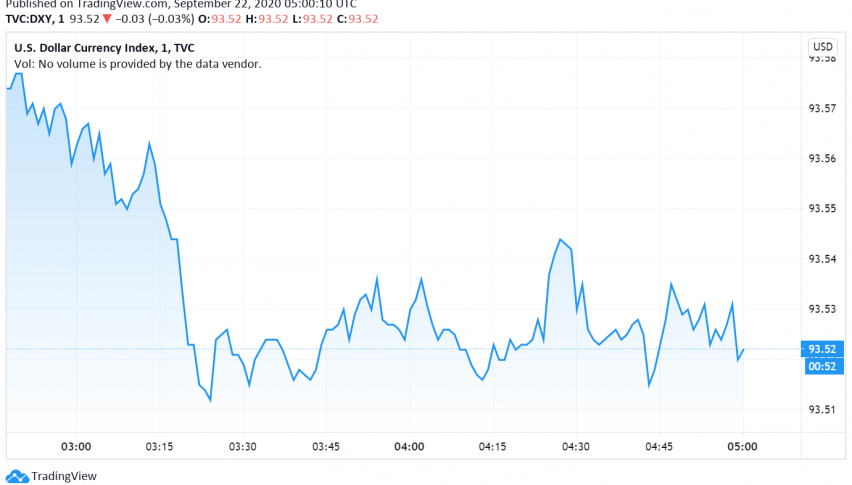

US Dollar Gains as Market Sentiment Deteriorates

The US dollar has regained its strength and is back on the bullish track amid a resurgence in the number of coronavirus cases even as markets worry about additional stimulus expected in the US to offset economic damage. At the time of writing, the US dollar index DXY is trading around 93.52.

During the previous session, the dollar soared to the highest level seen in six weeks, gaining against its major peers, including safe haven currencies like the JPY and CHF. The greenback gained as equity markets saw rampant sell-off and the risk sentiment soured as more countries imposed fresh lockdown restrictions due to a surge in the number of cases.

In addition, a new scandal about major banks involved in money laundering also hurt the market sentiment, spilling over from beyond the financial sector and into other sectors and asset classes as well. The US dollar also remains supported ahead of the upcoming presidential elections as investors see lesser chances of more stimulus measures being rolled out.

The strengthening of the dollar amid the prevailing risk-off sentiment in markets has sent commodity currencies like the AUD and NZD lower even as the Euro fell to a six-week low. The GBP is also trading bearish over rising worries that the UK could reimpose fresh lockdown measures.