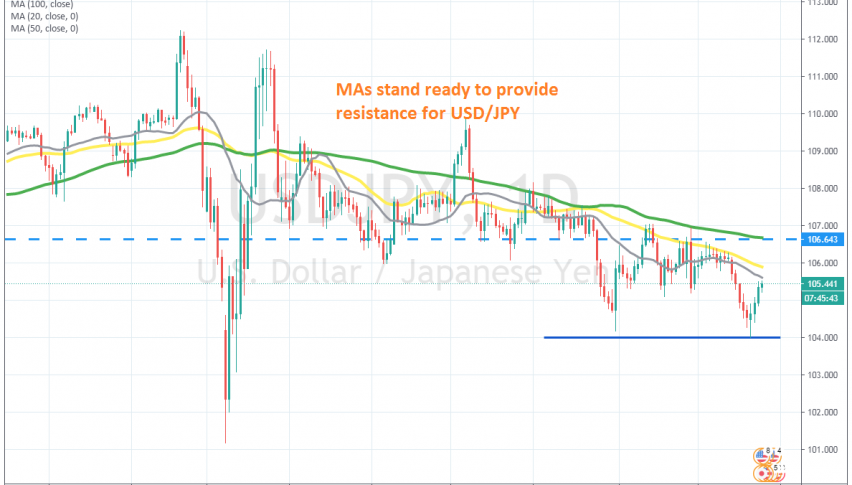

USD/JPY Stalling Below MAs – Is This the End of the Retrace?

USD/JPY has stalled below MAs on the daily chart

[[USD/JPY]] has been keeping a bearish bias since the roller-coaster back in March ended. Highs have been getting lower and despite one occasion in June when the sentiment in financial markets improved due to the global reopening, the price has remained largely below moving averages.

Moving averages have worked as resistance lately and we have seen two attempts from sellers, trying to push below 104, once at the end of July and again last week. But that level seems to be holding for USD/JPY and a support zone has formed down there, as shown on the daily chart.

The price reversed again from there on Monday, after forming a doji candlestick, which signaled a reversal. The price has climbed around 150 pips higher, but it seems to have stalled at around 105.50. The 20 and 50 SMAs are standing right above, ready to provide resistance, so this retrace higher might have come to an end now. We might try to open a sell forex signal from here, but we will see how the USD reacts, because it has turned quite strong this week. it t shows signs of wekanes and USD/JPY doesn’t climb higher, then we might go short from around here.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account