Daily Brief, October 22 – Everything You Need to Know About Gold Today

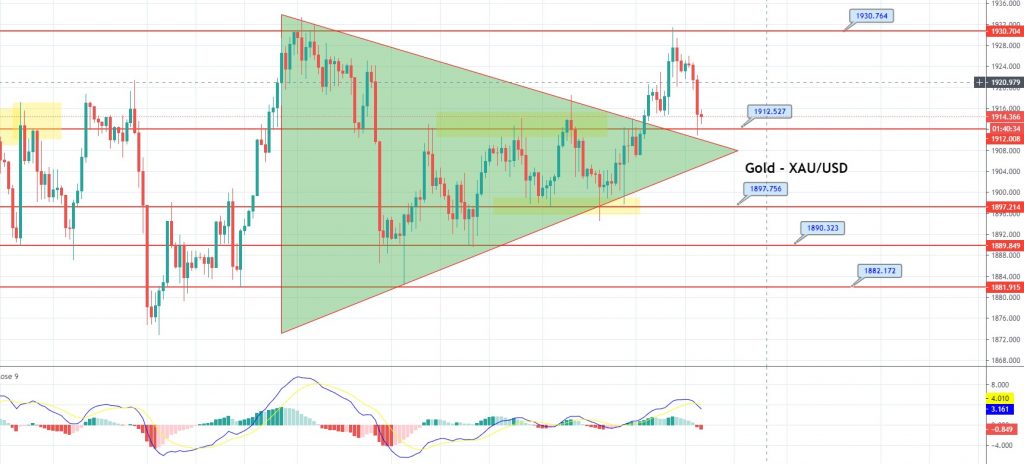

The precious metal gold is trading sharply bearish, falling from 1,930 level to 1,912 mark, the support level that's extended by previously

Prices for the precious metal, gold, closed at 1,924.54, after placing a high of 1,931.40, and a low of 1,908.02. Overall, the movement of gold remained bullish throughout the day. On Wednesday, the gold prices rose for the third straight day, on the back of the tumbling US dollar, as the yellow metal bulls chased the prospects of a coronavirus economic stimulus package being released before the US elections in two weeks.

The US Dollar Index, which measures the dollar’s value against its rival currencies, fell for the third consecutive day on Wednesday, losing almost 0.5% on the day, to hit the 92.46 level, which is its lowest level in seven weeks. The steep fall in the US Dollar Index was due to the speculation that the White House and US Congress were close to reaching an agreement on a new coronavirus relief package deal. The fall in the US dollar raised the yellow metal prices on the day.

The White House Chief of Staff, Mark Meadows, kept the hopes for a stimulus deal alive, saying on Wednesday that he was very hopeful that progress was being made in the negotiations. He added that the Trump administration and the House of Representatives Speaker Nancy Pelosi would continue talks over the coming days.

After the CARES Act, the Democrats have been locked in an impasse with President Donald Trump’s Republican Party over the next round of the stimulus package. The main dispute has been over the size of the bill, as thousands of Americans are at risk of losing their jobs without further aid, especially those working in the airline sector.

The chances of an agreement regarding the stimulus being reached before the November 3 presidential election, have created the whole buzz in the economy, and they have supported the gold prices lately. However, although an agreement could be reached by Pelosi and Mnuchin, doubts remain as to whether any bill around the $ 2 trillion mark will make it past the Senate.

If Joe Biden wins the election, the talks might have to wait until he takes office, and it is more likely that the stimulus will be much larger than what is currently being discussed. However, if Trump wins, a smaller deal would be reached before the end of the year. The Federal Reserve Governor, Lael Brainard, has said that another stimulus is critical for the economy, as it might be forced into a slower and weaker recovery from the coronavirus, without more aid.

Apart from the US stimulus issues, another reason behind the recent surge in gold prices was the dented risk sentiment, after some disappointing news from one of the front-runners in the race for a COVID-19 vaccine. On Wednesday, AstraZeneca reported that one of the patients had died during their vaccine trials. AstraZeneca’s shares fell to the lowest level since April, after this news, and favored an upswing in gold prices. However, the gains in the yellow metal were once again limited after the company reported that the patient was not given the vaccine.

Over the next couple of months, the first round of COVID-19 vaccine Phase 3 results will be delivered, and hopes are high that one or two will be approved and receive the green light before the end of the year. These hopes have also been weighing on the gold prices and keeping the gains in the yellow metal limited.

Daily Technical Levels

Support Resistance

1,902.14 1,923.14

1,888.87 1,930.87

1,881.14 1,944.14

Pivot Point: 1,909.87

Trading in the precious metal, gold, is sharply bearish, having fallen from the 1,930 level to the 1,912 mark, which is the support level that has been extended by the previously violated symmetric triangle pattern. On the lower side, the violation of the 1,912 support level may trigger more selling until the 1,897 level today. Conversely, gold has strong odds of bouncing off above the 1,912 level, to trade bullishly until the 1,930 level. Let’s consider buying over the 1,909 level today. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account