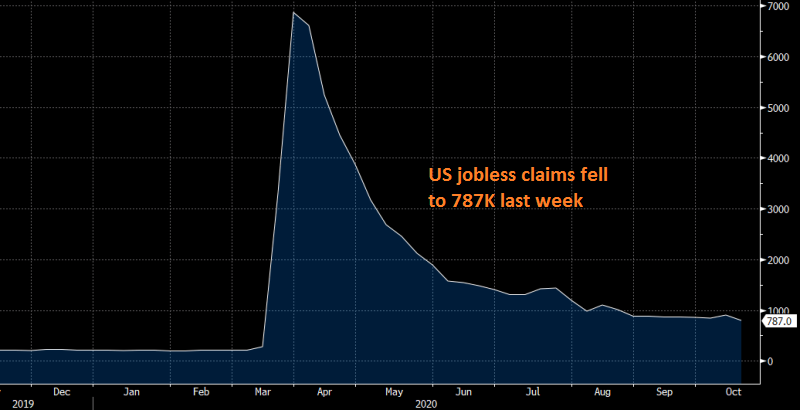

US Unemployment Claims Finally Fall Below 800K

US unemployment claims posted a decent decrease today, falling below 800K

•

Last updated: Thursday, October 22, 2020

The unemployment claims surged during the lock-down months in the US, as they did everywhere else. At some point in March, jobless claims jumped to above 6 million weekly. The unemployment rate surged above 20%, with more than 40 million unemployed people at the peak.

Jobless claims have been cooling off since then, falling below 1 million in September, but they were stuck above 800K for weeks. Today’s report showed that claims finally fell below 800K, which is a positive sign, but this is not helping the USD much.

Weekly US initial jobless claims data

- Initial jobless claims 787K vs 870K expected

- Prior week 898K, but revised down to 842K

- Continuing claims 8,373K vs 9,625K expected

- Prior continuing claims 10,018K (revised to 9,397K)

- PUA claims 345K vs 372K prior

- Total people collecting benefits in all programs 23,150,427 (-1,046,493 w/w)

These numbers are much better than expected. There is lots of talk about fraud in PUA claims, with Arizona rejecting 90% of claims. There is also the reporting mess in California, that’s slowly getting sorted out. Those numbers weren’t expected to be released so soon, and 27.9K in claims have been added.

“California has completed its pause in processing of initial claims and has resumed reporting actual unemployment insurance claims data, based on the weekly claims activity.”

All that said, 787K is still far above the pre-pandemic record of 665K. So, while jobless claims remain high, they are declining, which should help the USD at some point, once elections are over.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.