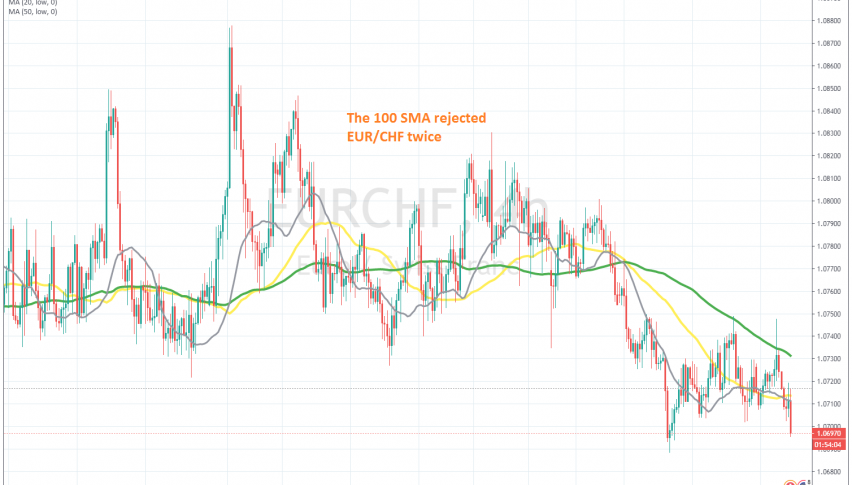

Closing EUR/CHF After the Tumble, on Deteriorating Risk Sentiment

EUR/CHF finally broke below 1.07 today, as the sentiment turned negative again in financial markets

The risk sentiment in the forex market has turned sour today. Safe havens, such as the JPY and the CHF, are climbing higher, while risk currencies, such as commodity dollars and oil are declining pretty fast. The stock markets felt this downturn in sentiment earlier this month, as they have already been bearish for two weeks.

The increasing coronavirus restrictions in Europe are showing their negative effects already, and the announcement of new restrictions today, from Germany and France, turned the sentiment even more negative. We had already been short on the EUR/CHF since last week, with the trend already being bearish.

The EUR/CHF tried to turn bullish yesterday, but the 100 SMA (green) stopped the climb for the second time and reversed the price down. Today, the sentiment turned more negative, giving this pair another push down below 1.07. The price hit our take profit level, so our sell forex signal here closed in profit.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account