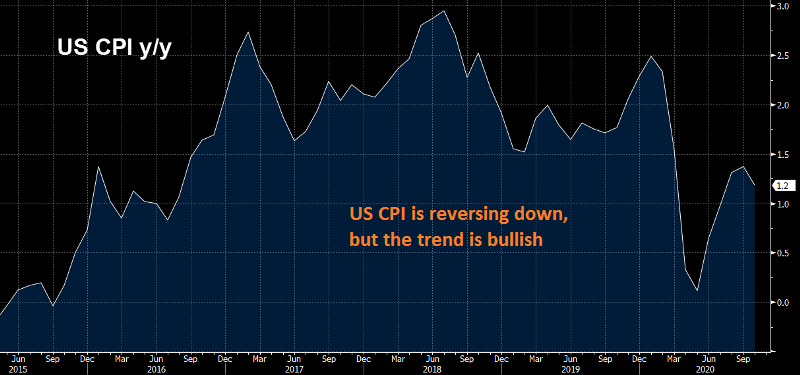

US Inflation Falls Flat in October

Headline and core CPI inflation came at 0.0% for October

•

Last updated: Thursday, November 12, 2020

Inflation turned negative in most places from March until May, as Oil prices were declining and the western world was on lock-down. But CPI (consumer price index) jumped during summer, as the global economy rebounded and US inflation grew by 0.6% on average. Although, it is cooling of again, falling negative in Europe since September. In the US, CPI cooled off and both headline and core CPI fell flat last month, while YoY CPI slowed to 1.2%.

US October CPI Report

- October CPI YoY +1.2% vs +1.3% expected

- September CPI YoY was +1.4%

- Core CPI YoY excluding food and energy +1.6% vs +1.7% expected

- Prior core CPI excluding food and energy +1.7%

- CPI MoM 0.0% vs +0.1% exp

- CPI MoM excluding food and energy 0.0% vs +0.2% expected

- Average weekly earnings +4.4% vs +4.4% prior

- Average hourly earnings +3.2% +3.2% prior

This is a miss but it’s not going to suddenly spur the Fed into action. Powell is watching the development in covid cases and restrictions. That’s going to be dominant in the next few months. Once we exit the pandemic then inflation is going to be top-tier news.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.