US Producer Inflation PPI Keeps the Pace, Despite the Growing Global Economic Weakness

PPI inflation ticked higher in october, while the global economy is declining

•

Last updated: Friday, November 13, 2020

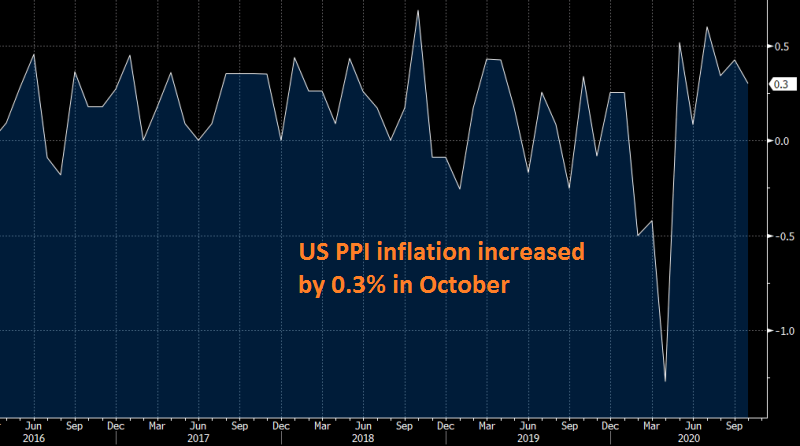

Inflation took a big hit in spring, as crude oil prices tumbled lower. The decline in oil prices translated into lower PPI (producer price index) inflation, which spilled over onto the CPI (consumer price index). But, inflation bounced higher during summer, after the reopening of the global economy.

However, the global economy is heading back into recession with the new lockdowns, which has turned inflation negative in some places, particularly in the Eurozone. In the US, CPI inflation is holding up a bit better, and the PPI report today actually showed a pickup for October.

US PPI Inflation Report for October

- October PPI +0.3% m/m vs +0.2% expected

- September PPI was +0.4%

- Ex food and energy +0.1% vs +0.2% exp

- Prior ex food and energy +0.4%

- Ex food, energy and trade +0.2% vs +0.2% exp

- Final demand y/y +0.5% vs +0.4% exp

- Prior final demand +0.4%

- Ex food and energy y/y +1.1% vs +1.2% exp

- Ex food, energy and trade +0.8% y/y vs +0.9% exp

Producer price inflation is not a big factor at the moment, but given the drop in oil prices and the fact that we’re in the midst of a raging global pandemic, it could certainly be worse.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.