WTI Crude Oil Trades Bearish – IEA’s Outlook on Oil Demand Weighs

WTI crude oil prices are sliding lower early on Friday as markets turned their focus on the rising number of coronavirus cases and its

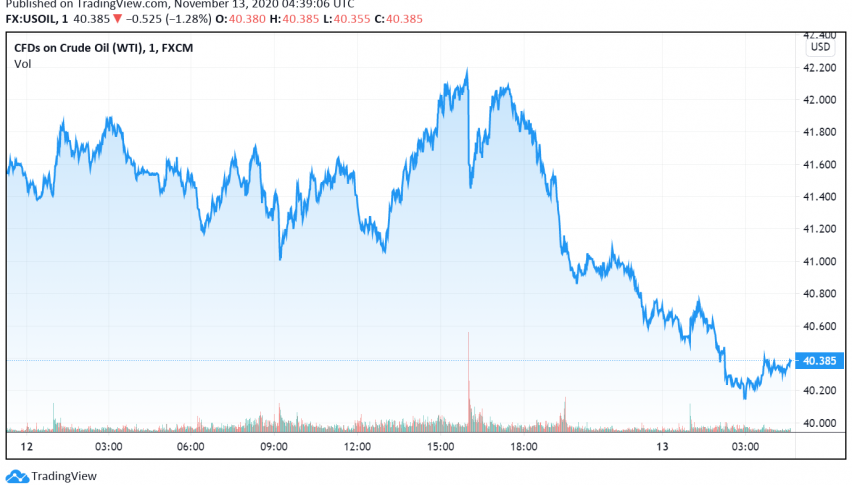

WTI crude oil prices are sliding lower early on Friday as markets turned their focus on the rising number of coronavirus cases and its impact on the global economy and oil demand. At the time of writing, WTI crude oil is trading at around $40.38 per barrel.

So far this week, however, WTI crude oil has gained around 10% of its value, buoyed by reports about a possible vaccine against COVID-19 from earlier this week. The initial optimism that sent the market sentiment soaring has eased and traders are back to worrying about the recent resurgence in cases across parts of Europe, US and Latin America.

US oil prices turned even more bearish following the release of the EIA report which revealed an increase in crude inventories over the past week. According to the EIA, crude stockpiles in the US increased by 4.3 million barrels during the previous week, against economists’ expectations for a decline by 913k barrels instead.

In addition, the IEA has cautioned that global oil demand could continue to remain weak well into 2021 despite the rollout of a possible vaccine next year. In its latest monthly report, the IEA observed, “It is far too early to know how and when vaccines will allow normal life to resume. For now, our forecasts do not anticipate a significant impact in the first half of 2021.”

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account