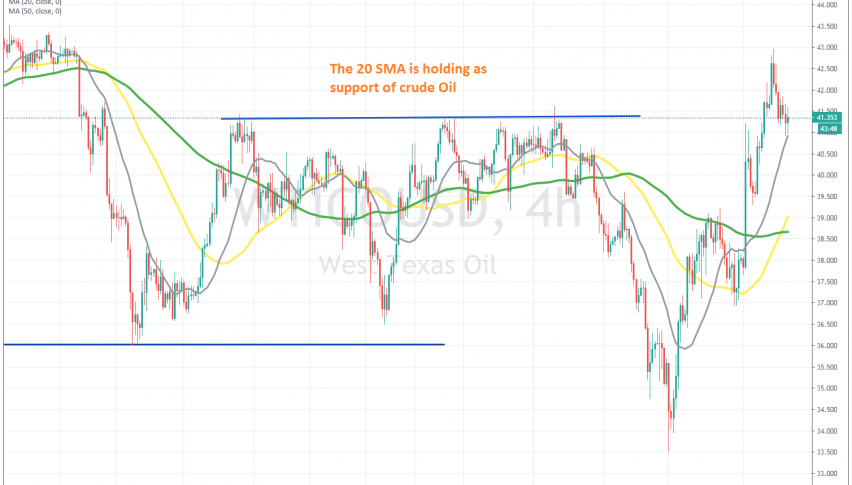

Will the 20 SMA Turn Into Support for Crude Oil?

The retreat in Crude Oil seems to be ending at the 20 SMA on the H4 chart

Crude Oil turned quite bullish from the middle of April, after the big crash in the previous months, which sent US WTI crude to -$40 back then. But, the situation reversed since April, since the world didn’t end because of the coronavirus and crude Oil climbed to $43.50 until the end of August.

The bullish trend ended with the summer and in September we saw a reversal down and a decline to $36, which has been a support zone before. During October, Crude Oil traded mostly sideways. Although, in the last week of last month the USD turned really bullish and crude Oil declined to $33.50s.

But, the USD reversed down again last week and the covid vaccine news this week improved the sentiment in financial markets. Oil turned bullish once again and moving averages turned into support. In the last few sessions, US WTI crude has pulled back lower, but the 20 SMA (grey) has caught up with the price on the H4 chart and it stopped the pullback. Now Oil is bullish again and the 20 SMA holding the decline, confirms the bullish bias.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account