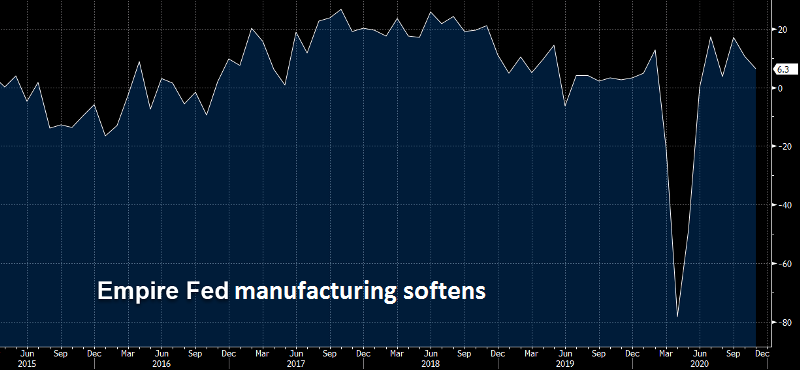

Manufacturing Declines in New York Area in November

All sectors of the US economy went through a big contraction during March and April, as major parts of the the country went into lock-downs. But it has bounced back nicely since the reopening in May, and it has been keeping the pace throughout all sectors. Although, the Empire State manufacturing index showed that activity has declined in the New York area in November.

New York-area manufacturing survey

- November Empire Fed manufacturing +6.3 points vs +13.5 expected

- October Empire Fed manufacturing was +10.5

Details:

- new orders index 3.7 vs. 12.3 last month

- shipments 6.3 vs. 17.8 last month

- number of employees 9.4 vs. 7.2 last month

- average workweek 4.8 vs. 16.1 last month

- unfilled orders -11.9 vs. -6.6 last month

- prices paid 46.4 vs. 27.8 last month

- prices received 23.2 vs. 5.3 last month

- inventories -8.6 vs. -14.6 last month

- six-month index 33.6 vs 32.8

This isn’t a big red flag but it is the first manufacturing data point of the month, and it shows some unexpected softness, particularly in orders. The worry would be that the pull-forward and pandemic sales are starting to fade, but it’s way too early to worry about that.

Check out our free forex signals

Follow the top economic events on FX Leaders economic calendar

Trade better, discover more Forex Trading Strategies

Related Articles

Comments

Subscribe

Login

0 Comments