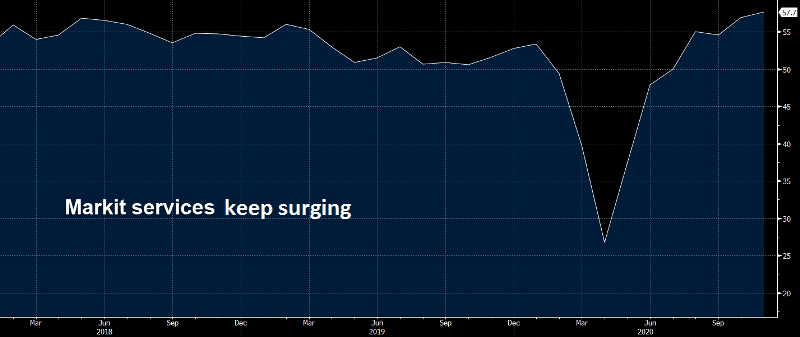

USD Turns Bullish for the First Time in November, After Great Services and Manufacturing Data

The US services and manufacturing activity surged further in November

The USD has been bearish since the middle of March, after the surge due to coronavirus panic in February. It tried to reverse higher in the last week of October, before the elections, but it failed and resumed the bearish trend once again. But, it is turning bullish now after the impressive manufacturing and services reports a while ago. Although, let’s see if this will last. We just bought GBP/USD at the 20 SMA (grey) on the H1 chart, since it has been providing support recently. EUR/USD on the other hand, has dipped to 1.18 lows.

Markit Manufacturing and Services Data, November 2020

- November US services PMI 57.7 points vs 55.0 expected

- Highest reading since April 2015

- October services were 56.9 points

- November manufacturing 56.7 points vs 53.0 expected — highest since Sept 2014

- October manufacturing was 53.3 points, revised to 53.4 points

- Manufacturing new orders 57.4 points vs 53.9 prior — highest since 2018

- Composite manufacturing 57.9 vs 56.3 prior — highest since March 2015

- Full report

“The November PMI surveys provide the first post-election snapshot of the US economy, and makes for very encouraging reading,though stronger economic growth is quite literally coming at a price. “First the good news: business activity across both manufacturing and services rose in November at the strongest rate since March 2015. The upturn reflected a further strengthening of demand,which in turn encouraged firms to take on staff at a rate not previously seen since the survey began in 2009. “However, the surge in demand and hiring has pushed prices and wages higher. Average selling prices for goods and services rose at the fastest rate yet recorded by the survey, with shortages of supplies also more widespread than at any time previously reported. “Firms are scrambling for inputs and workers to meet the recent growth of demand, and to meet rising future workloads. Expectations about the year ahead have surged to the most optimistic for over six years, reflecting the combination of a post-election lift to confidence and encouraging news that vaccines may allow a return to more normal business conditions in the not too distant future.”

There is some input inflation here and that’s going to be a story, even with central bankers taking their eye off the ball. The rise in services costs was the highest in survey history and manufacturers also reported very high input inflation and shortages. There has been a significant rally in the US dollar on this and gold is breaking support.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account