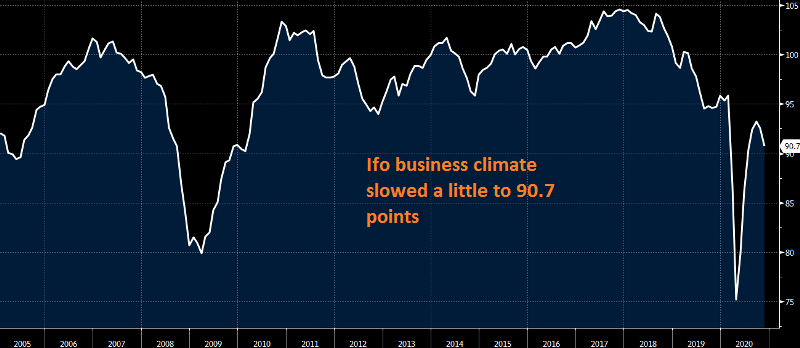

German ifo Business Climate Holds Well, Despite New Lockdowns

The German Ifo business climate cooled off this month, but only slightly

The first lockdowns in spring sent the European economy into a deep recession, with all sectors falling into the abyss. During summer, the situation improved as the continent reopened, and the economy rebounded. But new restrictions have increased, and Europe has gone into another lockdown, which has sent the service sector into recession once again.

However, the manufacturing sector is holding up, despite the new measures coupled with the business sentiment. This is a positive thing, because everyone was execting another deep recession this winter.

German ifo Business Climate Index for November, 90.7 vs 90.2 Expected

- November ifo business climate index 90.7 points vs 90.2 expected

- October ifo business climate was 92.7 points; revised to 92.5

- Expectations 91.5 points vs 93.5 expected

- Prior expectations were 95.0 points; revised to 94.7

- Current assessment 90.0 points vs 87.5 expected

- Prior current assessment 90.3 points ; revised to 90.4

A slight delay in the release by the source. The headline may be slightly better than estimates, but business morale still reflects a drop, with the expectations component also highlighting a more pessimistic outlook towards the economy, as we head towards year-end.

Comments by ifo economist Klaus Wohlrabe

- German industry activity not so affected by lockdown measures

- Industry has resisted the downtrend in the economy

- Export expectations have been dampened, are slightly negative again

- Q4 GDP to be slightly negative

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account