Vaccine Optimism Drives Traders Away From US Dollar to Risk Assets

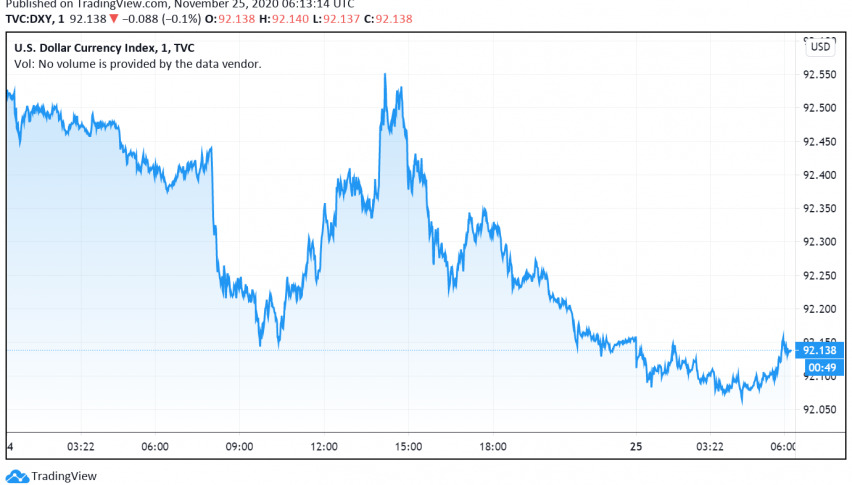

The US dollar is trading bearish early on Wednesday as traders move towards riskier instruments, buoyed by promising reports about possible vaccines against COVID-19 by three pharmaceutical companies so far. At the time of writing, the US dollar index DXY is trading around 92.13.

Against commodity currencies AUD and NZD, the greenback has weakened to a two-month low and a two-year low respectively. The dollar has also dropped to a two-week low against the Euro and trades at the weakest level in over two months against the Sterling as well.

The optimism about vaccines that could combat the coronavirus pandemic and boost economic recovery around the world is likely to keep the dollar trading under pressure in the coming sessions. According to latest news reports, the rollout of COVID-19 vaccines could begin as soon as by the end of this year, denting the safe haven appeal of the reserve currency.

Additional bearishness in the US dollar was triggered by rising expectations of a larger fiscal stimulus package expected to be rolled out once Biden comes to power. Biden’s choice of former Fed chair Janet Yellen as Treasury Secretary has increased the possibility of more stimulus measures, something Yellen has been quite vocal about previously.