US Dollar Weakens Amid Vaccine Optimism, Possibility of More Stimulus

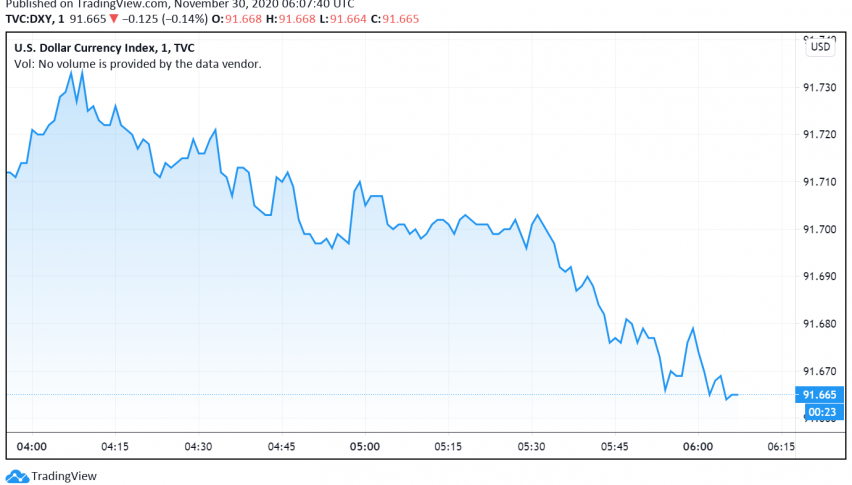

The US dollar is trading bearish, touching the lowest levels in over two years as the optimism around vaccines and expectations for more monetary easing and stimulus measures keeps the reserve currency under pressure. At the time of writing, the US dollar index DXY is trading around 91.66.

Meanwhile, commodity currencies like the AUD and NZD have risen to multi-month highs against the US dollar, with the NZD especially rising to the strongest level in two and a half years. The Euro is also gaining against the greenback, touching a three-month high and having strengthened by over 5% so far this month.

For the month of November, DXY has lost around 2.4% of its value, weighed down by rising hopes about COVID-19 vaccines that have dented the safe haven appeal of the US dollar. In addition, uncertainties surrounding the US presidential election results and expectations that the Fed and the government could unleash more stimulus measures are also exerting downward pressure on the currency.

Losses in the dollar, however, remain controlled by the continued increase in fresh coronavirus infections across the US and Europe that have raised the likelihood of more lockdowns and restrictions. Addition restrictions can further impact the economy and delay and possibility of a recovery, a concern that is supporting the safe haven appeal of the greenback for now.