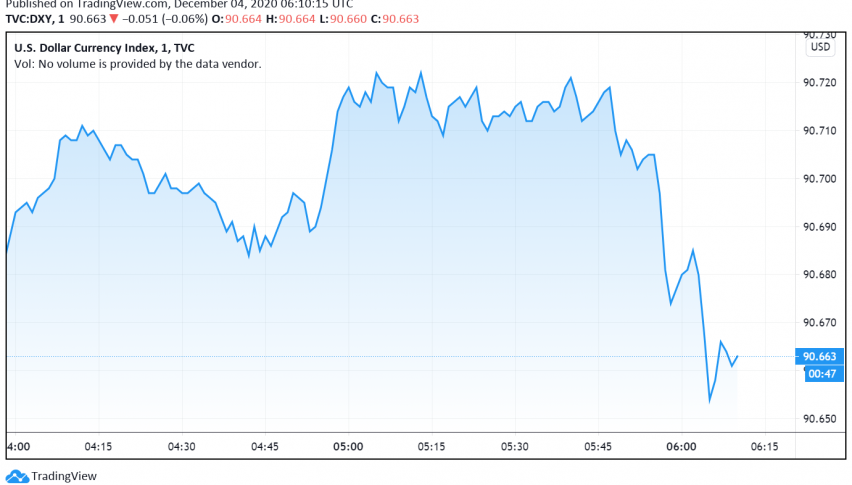

US Dollar Weakens as Risk Sentiment in Markets Improves

The US dollar continues to decline into Friday as the risk appetite in global markets strengthens over reports about the development and

The US dollar continues to decline into Friday as the risk appetite in global markets strengthens over reports about the development and rollout of vaccines that can effectively end the coronavirus pandemic. At the time of writing, the US dollar index DXY is trading around 90.66.

The safe haven appeal of the US dollar has suffered severely over the past few sessions after three leading pharmaceutical companies announced progress towards developing highly effective vaccines against COVID-19. Markets turned even more optimistic after Britain authorized the rollout of Pfizer’s vaccine across the country starting next week, as the focus now shifts towards hopes of economic recovery.

Traders have moved away from the safety of the greenback and towards riskier currencies. The Euro, especially, has posted strong gains on the back of this sentiment, and has already gained around 1.5% of its value so far this week, crossing the key 1.20 level.

Additional weakness in the US dollar was driven by rising hopes for more fiscal stimulus measures to be finalized to prop up the US economy. Earlier this week, leaders from both parties resumed discussions on the coronavirus relief package for the first time since the presidential election, and appear to be leaning towards a narrower package.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account