Canadian Economy Continues to Weaken

Canadian Ivey indicator declines for the fourth month in a row

•

Last updated: Monday, December 7, 2020

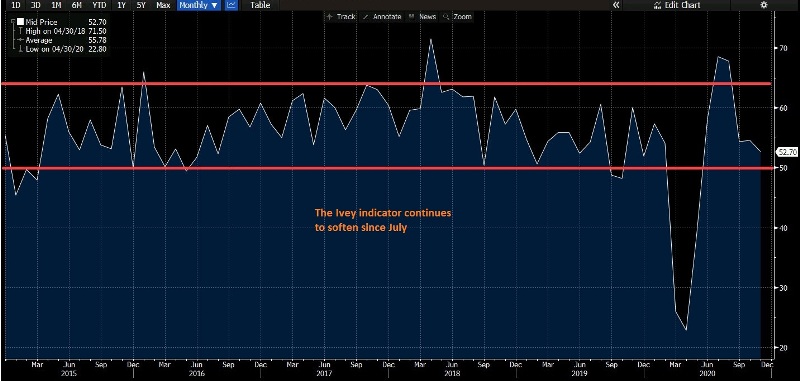

The Ivey indicator which surveys 175 purchasing managers, dived deep in March and April, suggesting a massive recession in those months, during the lock-downs. In June we saw a massive improvement, which continued in July, but since August this indicator has been declining, which tells us that the economy might head into another recession.

Ivey purchasing managers index for November 2020

- Ivey purchasing managers index for November 52.7 vs. 54.7 estimate

- Last month index was 54.5

- Ivey PMI index 52.7 vs. 54.5 last month

- 3 month average 53.8 vs. 58.9

- Employment 48.1 vs. 56.1 last month

- Inventories 49.3 vs. 45.5 last month

- Supplier deliveries 34.3 vs. 44.8 last month

- Price is 66.1 vs. 63.0 last month

A year ago the index stood at 60.0. In April the index dipped to the low at 22.8. The high rebound level reached 68.5 in July. Mostly Looking at the chart below, most of the monthly numbers have been mostly centered between the 50 and 65 levels. The index is pushing toward the lower of that range. Another caveat for the index is that it tends to swing around on a month-to-month basis. Nevertheless the move lower is the 3rd in 4 months.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.