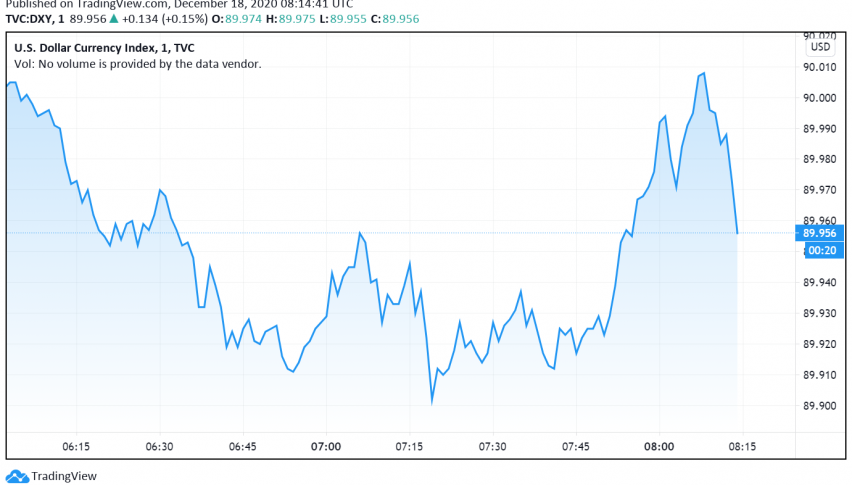

US Dollar Index Drops Below 90.00 as Market Sentiment Strengthens

The bearishness in the US dollar continues and looks ready to post the worst weekly decline seen in a month, as traders go short on the

Early on Friday, the bearishness in the US dollar continues and looks ready to post the worst weekly decline seen in a month, as traders go short on the reserve currency amid the improving risk sentiment in markets. At the time of writing, the US dollar index DXY is trading around 89.95.

Over the past few weeks, the US dollar has been driven lower over optimism surrounding the development and rollout of vaccines against COVID-19. This has increased investors’ appetite for riskier currencies instead of the safety of the greenback.

The dollar has dropped to the lowest level in nine months against the JPY while commodity currencies AUD and NZD have risen to the highest level seen in several years against it. Even the EUR, GBP and CAD have risen to multi-year highs against the USD.

Optimism about the vaccine rollout across the US, Britain and Canada and developments around the coronavirus relief package have been driving the US dollar weaker against its major peers. There is also guarded optimism in the markets that Britain and the EU could work out a post-Brexit trade deal soon, which would give traders one more reason to cheer.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account