FED the 3rd Central Bank to Loose the Drama, But the USD Still Not Impressed

The FED signaled on Thursday that it might change course soon if the situation improves in 2021

Central banks and governments panicked during the first wave of the coronavirus in spring, although that was justified, since the global economy went into a quick recession. Governments and central banks threw trillions of dollars into the economies of their countries, which helped the economy recover during summer, but the new restrictions and lock-downs are hurting the developed economies again.

The Eurozone economy is heading down towards stagnation, although some economies are holding well. The US economy is one of them, despite some weakness shown in the recent data. This puts analysts in the dilemma of what position the FED would take now. The Reserve bank of Australia and the Reserve Bank of New Zealand sounded less dovish in the last meetings, which has been one of the reasons for the climb in AUD/USD and NZD/USD, apart from the USD weakness and the risk positive sentiment due to the new stimulus programmes that central banks and governments are re introducing.

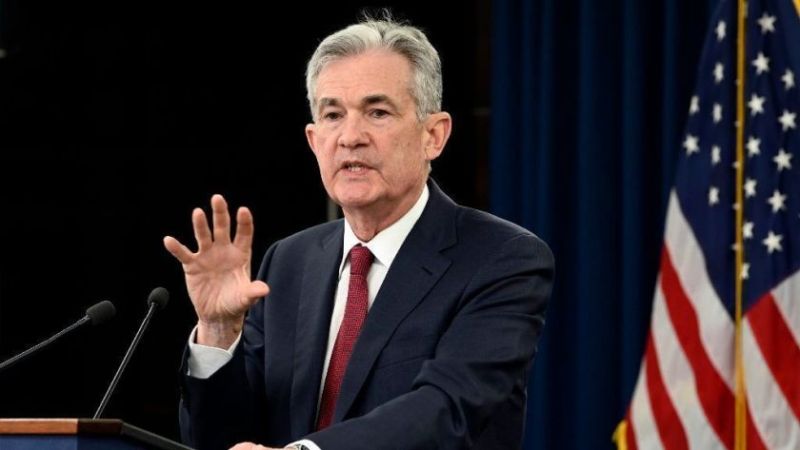

The FED meeting was on Thursday this week, which had traders glued to their screens. The FED released their statement and chairman Powell made his statement, which didn’t sound at dramatic and dovish as the previous ones, which is a positive change.

Highlights of the December 16, 2020 FOMC statement

- No change in weighted average maturity of portfolio

- Rates left unchanged at 0.00%-0.25%

- Interest on excess reserves % vs +0.10% expected

- Repeats that “committed to using its full range of tools to support the U.S. economy”

- Will continue to buy $80B/month in Treasuries and $40B/month in MBS

- Will continue bond buys “until substantial further progress has been made toward the Committee’s maximum employment and price stability goals.”

- Repeats that “The ongoing public health crisis will continue to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term”

- Dot plot at end of 2023 remains at zero.

The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time.

Jerome Powell’s Comments

- Spending on household goods has recovered but spending on services still lower

- Recovery has been quicker than expected

- Forecasts have been boosted since Sept

- Will not lose sight of millions out of work

- Outlooks is extraordinarily uncertain and depends on the virus

- It remains difficult to assess timing and scope of vaccine rollout

- Next few months are likely to prove very challenging

- Fewer at the Fed see risks to the downside than in Sept

- If progress to our goals were to slow, our policy is designed to react

- It will take ‘awhile’ to get back to levels in economy and employment from the beginning of 2020

- We are committee to using full range of tools

- I don’t think the change in downside risks is material. Few people would disagree with that assessment.

- New guidance is powerful

- Employment will need to be ‘substantially’ closer to full employment

- Lowering bond buys ‘is some ways off’

- When we see that progress we will say so ‘well in advance’ of tapering

- We feel like our purchases, right now we’re providing a great deal of stimulus

- Any time we feel more purchases will help economy, we will do it

- Doing a BOC-style twist where they lower purchases but extend maturity ‘isn’t high on our list’ of possibilities

- The case for fiscal policy action is “very, very strong”

- My expectation is H2 2021 US economy will be strong

- Some of the demand for housing may be pent-up

- Many homebuilders we met with said they’ve never seen anything like it

- Housing prices aren’t a financial stability concern

- We’re aiming for an inflation overshoot but it will take some time to get there. Would it really shift the timeline by changing composition of asset purchases?

- Markets have found the Fed credible on the new inflation framework, I’m pleased by how markets have moved

- We do have the ability to buy more bonds and the day to use it may come

- ‘We remain open’ to increasing purchases or moving to longer maturities but we think current stance is appropriate

- We think our guidance today will provide support

- It looks like at this time that what is needed is fiscal policy

It’s fanciful to think that the Fed would ever nail itself down with action tied to hard numbers. On inflation, he indicated that the Fed would look through a jump in 2021 inflation.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account