US Dollar Steadies After Volatile Trading: Risk-off Mood Supports

The US dollar is trading somewhat steady on Tuesday experiencing high volatility during the previous session as the mood in the markets

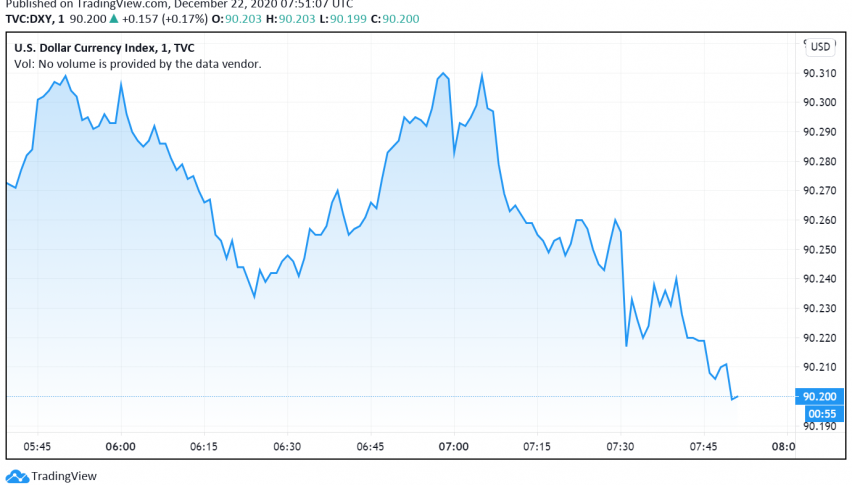

The US dollar is trading somewhat steady on Tuesday experiencing high volatility during the previous session as the mood in the markets soured over news of the new strain of coronavirus detected in the UK. At the time of writing, the US dollar index DXY is trading around 90.20.

Thin liquidity in financial markets ahead of the year-end holidays turned trading even more volatile for other currencies as well, as traders moved from riskier currencies and towards the safety of the US dollar. Meanwhile, the GBP declined by around 2.5% on Monday as several countries closed their borders to passenger and freight traffic from the UK.

Markets are worried about how the latest strain of coronavirus could force the UK as well as other European countries to impose tighter lockdowns to contain the pandemic. The economic impact of fresh lockdowns has turned the mood, which was previously upbeat over the development and rollout of COVID-19 vaccines.

The risk-off sentiment in markets was further bolstered by the lack of a post-Brexit trade deal between Britain and the EU. Despite repeated round of negotiations and only a few days left for the transition period to end, the EU and the UK have still been unable to work out their differences and come to an agreement, on the issues of fishing rights and level-playing field on standards.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account