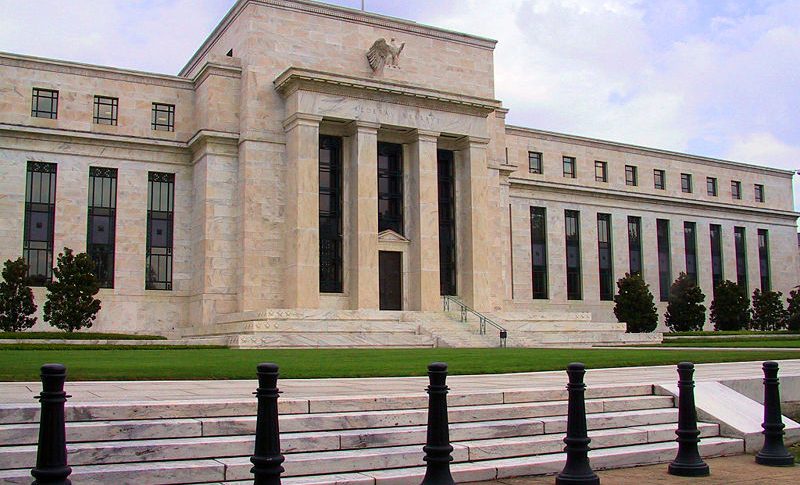

December FOMC Minutes: Recap & Highlights

December’s FOMC Minutes are overtly dovish, suggesting that open market operations remain elevated and rates be held static at 0%.

It’s been a politically-charged news cycle and wild day on the forex. The price action is unique for an FOMC Minutes session, but the Greenback is hanging in there vs the majors. Two of the biggest movers have been the USD/JPY and USD/CHF, with each posting significant intraday bullish trends.

Aside from today’s FOMC Minutes, the ADP Employment Report (December) painted an ominous picture of the American labour market. According to ADP figures, private companies slashed 123,000 jobs for December. This is an extremely negative number, especially when compared to the expected 88,000 job gain. The decline is the first since last April, signifying that corporate interests are preparing for a rocky road ahead.

Let’s dig into today’s FOMC release and check out a few of the highlights.

FOMC Minutes: Recap And Highlights

All in all, the December FOMC Minutes was a neutral economic event. The FED remained overtly dovish, with concerns over COVID-19 dominating policy decisions. Subsequently, interest rates were held at 0% and unlimited quantitative easing (QE) was left in place. So, is the FED preparing to take a more hawkish stance in 2021? Judging by today’s minutes, rate hikes and an end to QE is unlikely anytime soon.

Here are the key takeaways from this afternoon’s release:

- Members expected to maintain an accommodative stance of monetary policy until inflation runs above 2% for some time.

- All members voted to hold the federal funds target rate at 0.0% to 0.25%.

- Unanimously, members agreed that increasing U.S. Treasury holdings by at least $80 billion per month was appropriate. Also, an increase of $40 billion per month in mortgage-backed securities was deemed necessary.

- “US real GDP continued to recover in Q4, but at a more moderate pace than Q3.”

- “Consumer price inflation remained notably below rates seen in early 2020.”

- “The expected path of the federal funds rate remains close to the effective lower bound through mid-2023.”

Bottom Line: It’s more of the same from the FED. December’s FOMC Minutes are overtly dovish, suggesting that open market operations remain elevated and rates be held static at 0%. So, it looks like at least 12 more weeks of winter for the Greenback.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account