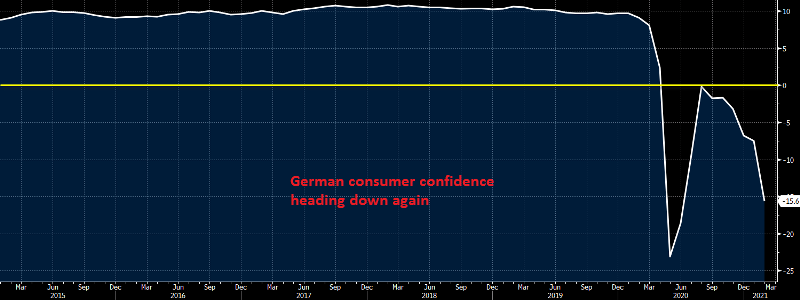

Consumer Confidence Deteriorates Further in Germany, Sending the EUR/USD Lower

German GfK consumer confidence indicator for January declined to -15 points

The coronavirus restrictions have been increasing in Germany in recent weeks, which is hurting the economy, with the exception of manufacturing, since large production facilities remain open. But, the smaller businesses are suffering, and consumer confidence is turning lower.

In fact, consumer confidence has been negative since April last year, but after an improvement in summer, it began weakening again in autumn, and today’s report is showing another decline. The EUR/USD turned lower after that report, losing more than 50 pips.

Germany February GfK Consumer Confidence Report

- February GfK consumer confidence -15.6 points vs -7.9 expected

- January GfK consumer confidence was -7.3 points; revised to -7.5

German consumer morale has dipped for the fourth month in a row as tighter lockdown measures continue to weigh on the sentiment as we head towards February. This is the lowest reading since June, and it doesn’t provide much confidence to start the new year. GfK notes that:

“Closing large parts of the retail sector has hit the propensity for consumer buying just as hard as it was hit during the first lockdown in spring last year. In other words, the recovery that many had hoped for this year will be postponed.”

Comments by ECB policymaker, Klaas Knot

- ECB has tools to counter euro appreciation if needed

- ECB is monitoring strengthening the euro

- Euro strength would take precedence for ECB if it threatens inflation outlook

- ECB taking a holistic view on financing conditions

- ECB hasn’t reached lower boundary, still room for rate cuts

- Too early to talk about exit from low rates

- There should be room for optimism after the summer

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account