Looks Like the Eurozone Missed Another Recession in Q4 2020

The GDP of Eurozone is heading towards recession again, but it might miss it in Q4 of 2020

The Eurozone economy fell into recession in Q2 of 2020, with the German economy declining by more than 10%, due to the lockdowns, which hurt everyone. In Q3 we saw a strong bounce of 8%, but with the new coronavirus restrictions in winter and lockdowns being implemented in the region once again, expectations were for a possible recession in Q4. But, although the French report was negative, it seems like the Eurozone economy is going to miss a recession narrowly, taking into account the German and Spanish GDP reports today.

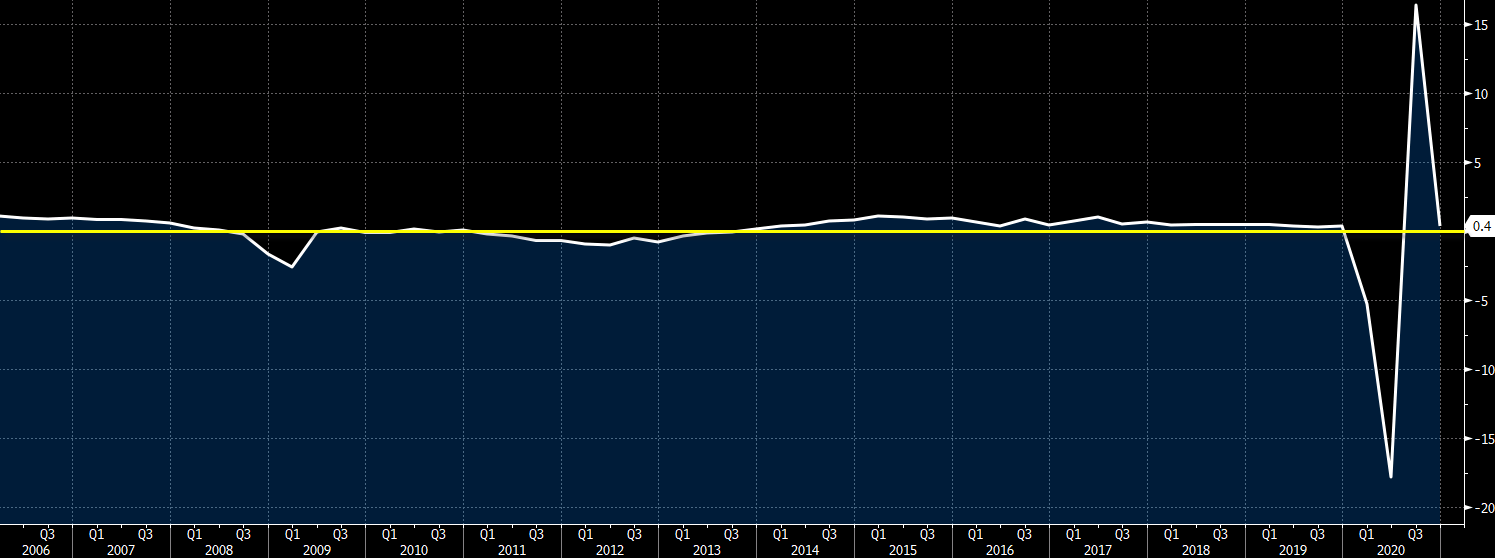

Germany Q4 preliminary GDP

- Q4 preliminary GDP QoQ +0.1% vs 0.0% expected

- Q3 GDP was+8.5%

- Q4 GDP YoY (non-seasonally adjusted) -2.9% vs -3.2% expected

- Q3 GDP YoY was -3.9%

- Q4 GDP YoY (working day adjusted) -3.9% vs -4.0% expected

- Prior was -4.0%

German economic output basically ground to a halt in the final quarter of last year, barely escaping from posting a contraction again, following a robust performance in Q3. This does reflect slight optimism that economic activity wasn’t as bad as feared towards the end of last year, but the threat of a double-dip recession still remains a possibility.

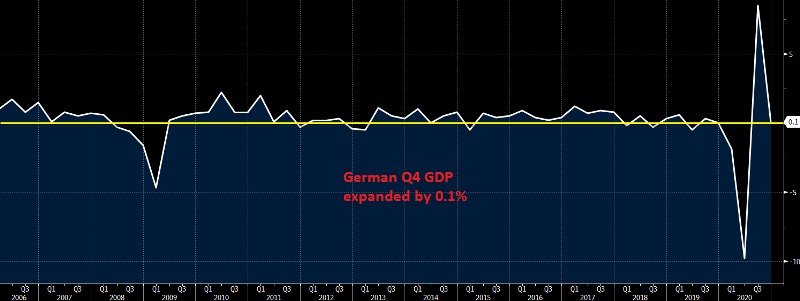

Spain Q4 preliminary GDP

Spanish GDP grew by 0.4% in Q4

- Q4 preliminary GDP QoQ +0.4% vs -1.5% expected

- Q3 GDP was +16.4%

- Q4 GDP YoY -9.1% vs -10.8% expected

- Q3 GDP YoY was -9.0%

Spanish economic activity beat the estimates, posting a quarterly growth in the final quarter of last year, in what appears to be a one of the few bright spots in the Eurozone economy.

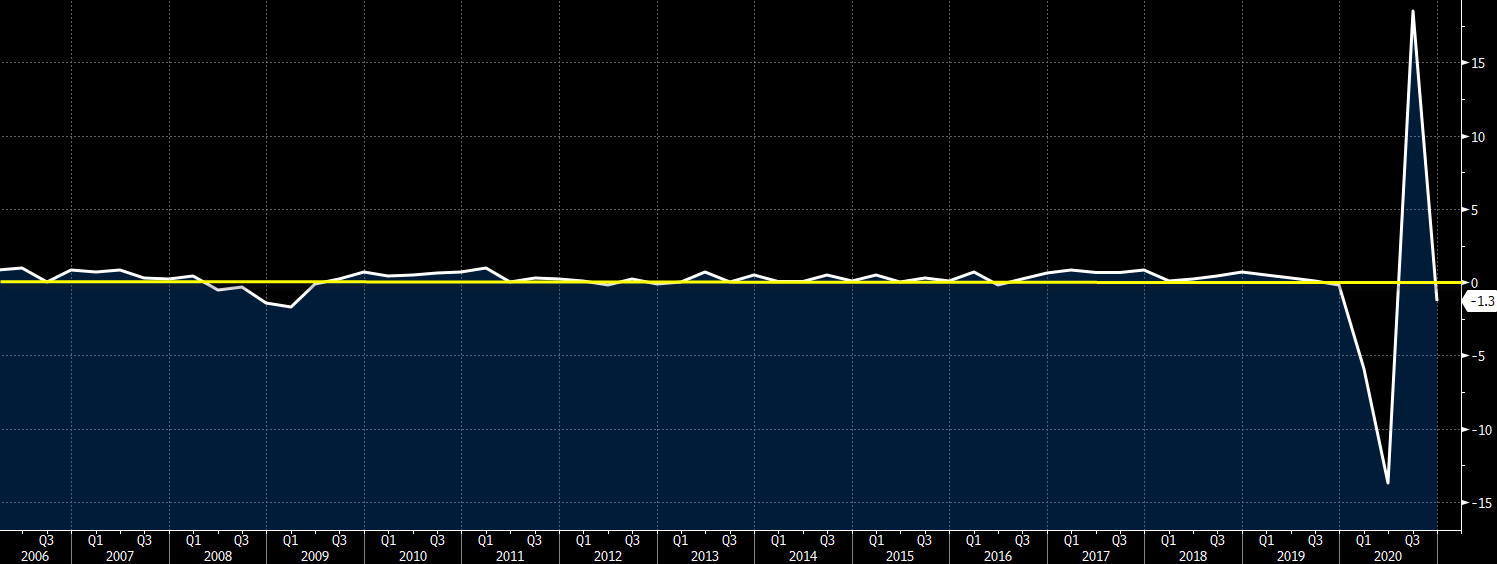

French Q4 preliminary GDP

- French Q4 preliminary GDP QoQ -1.3% vs -4.0% expected

- Prior (Q3) GDP QoQ +18.7%; revised to +18.5%

- Q4 GDP YoY -5.0% vs -7.6% expected

- Prior (Q3) -3.9%

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account