GBP/USD Jumps 80 Pips Higher on the BOE, While Construction Turns Negative Again

GBP/USD has jumped higher as the BOE remains on hold again

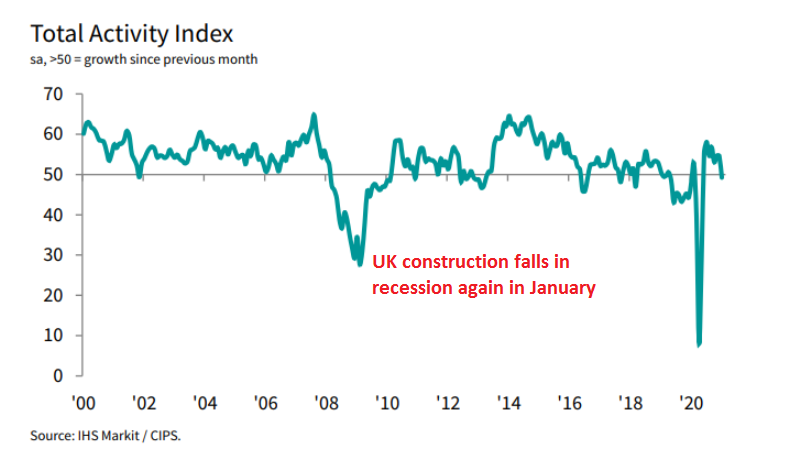

Construction is one of the strongest sectors of the UK economy, and it has also been quite resilient. It bounced back after the 2008 financial crisis and again after the lockdowns last year. But, with the new coronavirus restrictions in the UK, this sector tumbled into contraction again, after several months of expansion.

This is another negative component for the UK economy. Nonetheless, the GBP has jumped higher, with the GBP/USD trading around 80 pips up, after the Bank of England meeting, which left everything as it was. I assume traders were expecting the BOE to announce or hint at more monetary stimulus, which didn’t come this time.

UK January Construction PMI Report

- January construction PMI 49.2 vs 52.8 expected

- February construction PMI 54.6

The marginal decline last month marks an end to the seven consecutive months of expansion in UK construction activities, as lockdown measures weighed on new order growth, resulting in a drop in overall construction output for the first time since May last year.

“The construction sector ended a seven-month run of expansion in January as a renewed slide in commercial work dragged down overall output volumes. House building was the only major construction segment to register growth, but momentum slowed considerably in comparison to the second half of last year.

“Construction companies continued to report major delays in the receipt of imported products and materials from suppliers, with congestion at UK ports contributing to the sharpest lengthening of delivery times since May 2020. Adding to the squeeze on the construction sector, rising steel and timber costs led to the fastest rate of input price inflation in just over two-and-a-half years.

“The latest survey highlighted that construction companies have become more cautious about the business outlook. Output rebounded quickly after stoppages on site at the start of the pandemic, but hesitancy among clients in January and worries about near-term economic conditions resulted in a dip in growth expectations for the first time in six months.”

BOE Monetary Policy Decision – February 4, 2021

- BOE leaves bank rate unchanged at 0.10%

- December bank rate was 0.10%

- Bank rate votes 0-0-9 vs 0-0-9 expected

- Gilts purchases £ 875 billion

- Corporate bond purchases £ 20 billion

- Total asset program £ 895 billion (unchanged)

- Existing stance of monetary policy remains appropriate

- Financial markets have remained resilient

- GDP is projected to recover rapidly towards pre-virus levels over 2021

- Vaccine rollout is assumed to lead to an easing of virus-related restrictions

- Outlook for the economy remains unusually uncertain

- CPI inflation is expected to rise quite sharply towards the 2% target in the spring

- Does not intend to tighten monetary policy, at least until there is clear evidence that significant progress is being made in eliminating spare capacity and achieving the 2% inflation target sustainably

- Full statement

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account