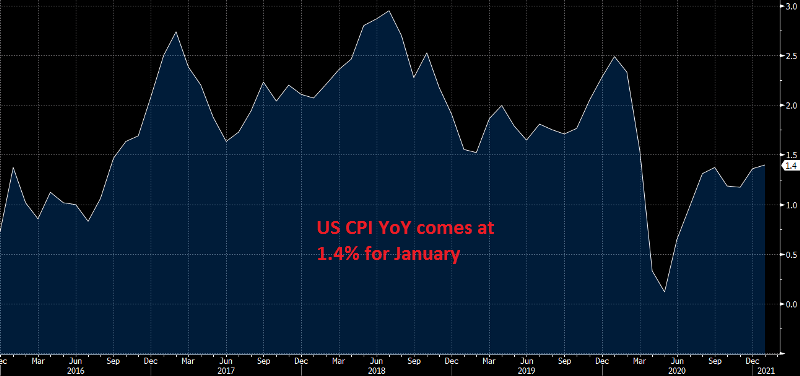

US CPI Inflation Softens in January

Inflation turned weaker in the US in January, sending the USD down

•

Last updated: Wednesday, February 10, 2021

Inflation picked up in the US after the dip early in 2020 due to the dive in crude Oil prices. It came back, but core CPI (consumer price index) fell flat in October at 0.0%. It increased again,but today’s report is showing another flatlining for core CPI, while headline CPI MoM increased by 0.3%. The annualized numbers were alo weak, so the USD fell through an air pocked for awhile after this report.

US January CPI Inflation Report

- January CPI YoY+1.4% vs +1.5% expected

- December CPI was +1.6%

- Core CPI YoY, excluding food and energy +1.4% vs +1.5% expected

- December core CPI YoY, excluding food and energy +1.6%

- January CPI MoM +0.3% vs +0.4% expected

- December CPI MoM reading was +0.2%

- Core CPI MoM ex-food and energy 0.0% vs +0.2% expected

Wage data:

- Real avg hourly earnings YoY +6.1% vs +5.3% prior

- Real avg weekly earnings YoY +4.0% vs +4.1% prior

It’s only one tick to the downside but with inflation worries starting to pick up, that’s a big tick. The flat core reading (for the second month) is also soothing for the market. Treasury yields are fractionally lower today and we have a 10-year sale later.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.