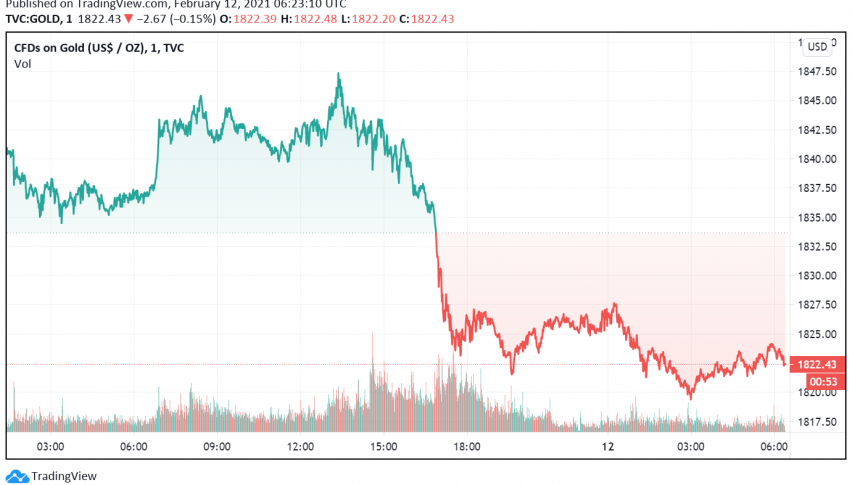

Gold Dips But Set to Post Weekly Gain – US Stimulus Hopes Support

Gold prices are exhibiting signs of weakness on the back of rising US Treasury yields, but are all set to end the week in green as hopes for

Early on Friday, gold prices are exhibiting signs of weakness on the back of rising US Treasury yields, but are all set to end the week in green as hopes for more stimulus measures in the US boost its safe haven appeal. At the time of writing, GOLD is trading at a little above $1,822.

Gold shares a negative correlation with treasury yields, as higher yields increase the opportunity cost of holding non-yielding bullion. US Treasury yields have been strengthening in recent sessions as markets eagerly await developments towards the implementation of President Biden’s proposal for an addition $1.9 trillion worth of fiscal stimulus.

Trading volume remains somewhat on the lower side due to some markets in Asia remaining closed on account of the Lunar New Year holiday. However, in the absence of market moving events releasing in the Asian session, gold traders remain focused on the possibility of more fiscal stimulus to prop up the US economy.

Gold prices are also enjoying support from weak economic data releases from the US, including the latest weekly jobless claims figures. Even though jobless claims dipped slightly, the overall numbers still remain high, pointing to signs of strain in the US labor market due to the ongoing coronavirus crisis.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account