Safe Haven Appeal of US Dollar Dips as WHO Approves One More Vaccine

The bearish run in the US dollar continues into early trading on Tuesday as the market sentiment received a boost from the WHO approving one

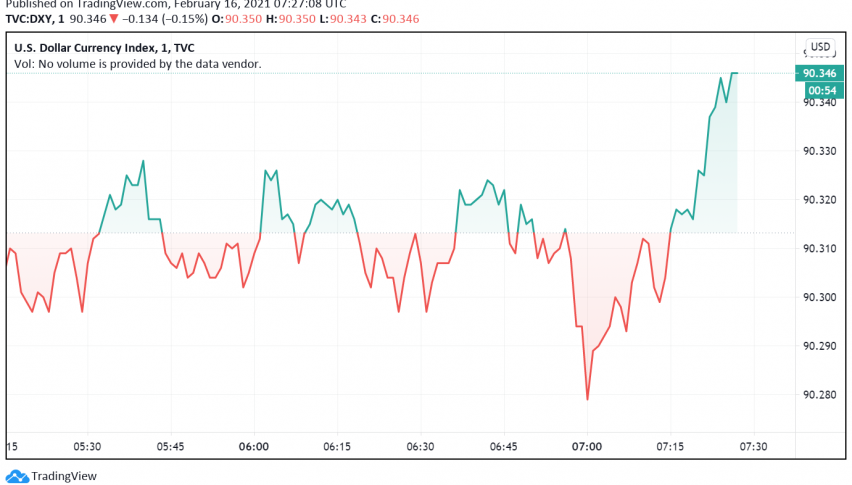

The bearish run in the US dollar continues into early trading on Tuesday as the market sentiment received a boost from the WHO approving one more COVID-19 vaccine for emergency use, improving the risk appetite of traders over the possibility of faster global economic recovery. At the time of writing, the US dollar index DXY is trading around 90.34.

Trading volume remains thin amid the Chinese New Year holidays and the holiday in US markets during the previous session, but the dollar remained under pressure, falling to an over two-year low against the Euro and even the AUD. Meanwhile, the Chinese yuan is also benefitting from the greenback’s weakness and looks set to take out the 6.4 level for the first time in nearly two years.

The GBP soared to the highest level in almost three years against the dollar over rising hopes that the rapid COVID-19 vaccine rollout across the UK could boost its economic recovery. In a span of less than two weeks, GBP/USD has strengthened by around 2.5% as markets expect the UK economy to rebound faster than its European counterparts.

On Monday, the WHO granted authorization for the emergency use of the COVID-19 vaccine developed by AstraZeneca and Oxford University. This vaccine is far more inexpensive than the ones from Pfizer and Moderna and would be far more accessible to many more countries worldwide, help bring the pandemic under control and spur a rebound in the global economy – a development that has boosted the risk sentiment and weakened the safe haven appeal of the US dollar.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account