UK Services Jump, But Remain in Recession

GBP/USD continues to be bullish, with services posting a jump this month

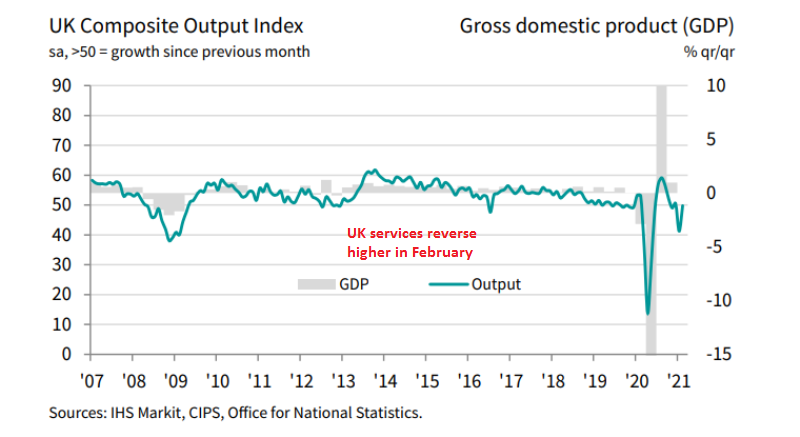

Services are the main sector of the UK economy, since Margaret Thatcher removed the manufacturing base in the ’70s, turning the UK into a service economy. They make up for around 80% of the economic output and used to be one of the strongest sectors as well, but with the new restrictions, this sector fell into recession in October.

The decline deepened in December, but today we are seeing a jump in this month’s initial report, although, they still remain in recession below the 50 point. The GBP/USD continues to be bullish today, heading for 1.40.

UK February Preliminary Services PMI Report

- February preliminary services PMI 49.7 points vs 42.0 expected

- January services PMI was 39.5 points

- Manufacturing PMI 54.9 points vs 53.1 expected

- January manufacturing was 54.1 points

- Composite PMI 49.8 points vs 42.6 expected

- January composite PMI was 41.2 points

The UK services sector has bounced back strongly in February, after the slump last month, with only a fractional decline observed in private sector output. That points to a broad stabilization in services activity – largely helped by business and financial services firms.

“The UK economy showed welcome signs of steadying in February, after the severe slump seen in January, albeit with business activity remaining sharply lower than late-last year, due mainly to the ongoing national lockdown.

“Although the hospitality sector, including hotels and restaurants, reported a further steep decline, as did the transport and travel sector, rates of contraction eased considerably. Business and financial services companies meanwhile recovered to register modest expansions, helping the hard-hit service sector to come close to stabilising.

“In contrast, the manufacturing sector’s performance worsened amid escalating Brexit-related export losses and supply chain disruptions. More than half of all companies reporting lower exports attributed to the decline due to Brexit-related factors. Brexit was also the most commonly cited cause of supply delays.

“More encouragingly, although the data hints at a renewed contraction of the economy in the first quarter, business expectations for the year ahead improved to the highest level in almost seven years, suggesting the economy is poised for recovery. Confidence continued to be lifted by hopes that the vaccine roll-out will allow virus-related restrictions to ease, outweighing concerns among many other firms of the potential further damaging impact of Brexit-related trading issues.”

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account