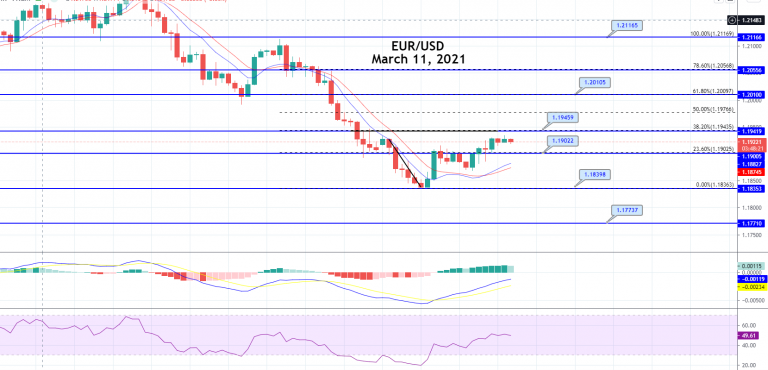

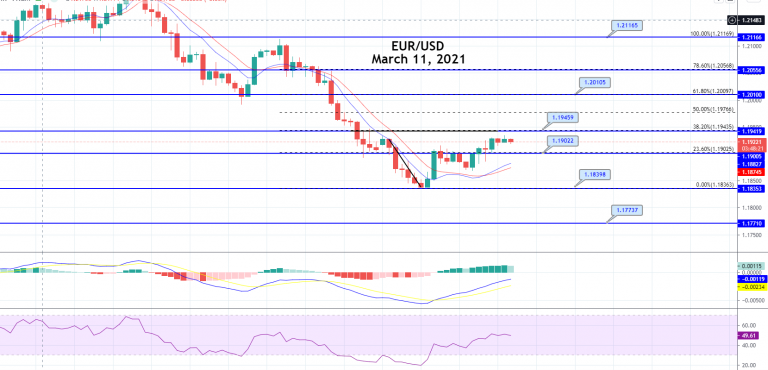

EUR/USD Heading Towards 38.2% Fibo Level – Brace for ECB Policy Today!

The EUR/USD is trading with a bearish bias at 1.1870 level, exhibiting bullish correction until 23.6% Fibonacci retracement level of 1.1902.

The EUR/USD pair closed at 1.1925 after placing a high of 1.1931 and a low of 1.1868. EUR/USD extended its gains for the second consecutive session on Wednesday amid the US stimulus decision on the day and other supporting factors. On Wednesday, the European Union defended itself against the accusations of vaccine nationalism. The EU highlighted its role in producing coronavirus vaccines for export and called out the United States and Britain for not sharing their vaccines with the world.

Last week when Italy blocked 250,000 AstraZeneca vaccine doses to Australia, the EU came under heavy criticism. This export was blocked due to vaccine shortages and delayed supplies in the home country. EU defended itself and emphasized that just one shipment was held back while 257 others have gone out. On Wednesday, a European Commission official said that the bloc had approved the export of more than 34 million coronavirus vaccine doses since late January. The biggest recipient of those was Britain with 9 million doses, followed by Canada with 4 million, and Mexico with 3 million doses. The EU has also approved about 1 million doses to the United States.

The EUR/USD pair rose on Wednesday after the publication of macroeconomic data from both sides as the data from Europe came in favor of the Euro and the CPI data from the US came against the US dollar. At 12:45 GMT, the French Industrial Production in January raised to 3.3% against the expected 0.5% and supported Euro and added gains in this pair. From the US side at 18:30 GMT, the US’s Consumer Price Index for February remained flat against the forecasts of 0.4%. In February, the Core Consumer Price Index declined to 0.1% against the forecast 0.2% and weighed on the US dollar and added further gains in the EUR/USD pair.

Meanwhile, the US treasury yields slipped slightly on Wednesday after the key 10-year Treasury auction data showed enough demand to reduce fears among investors about a possible decline in demand for the government’s debt and a recent rise in rates. On Thursday, the European Central Bank will announce its latest decision on monetary policy. The interest rates are expected to remain in place as well as the PEPP. The event will also include fresh growth and inflation forecast, which will be under observation by Euro traders to find fresh clues about the future trend in EUR/USD. The central bank is expected to signal faster money printing to keep a lid on borrowing costs.

Daily Technical Levels:

Support Resistance

1.1885 1.1948

1.1846 1.1970

1.1823 1.2010

Pivot Point: 1.1908

The EUR/USD is trading with a bearish bias at 1.1870 level, exhibiting bullish correction until 23.6% Fibonacci retracement level of 1.1902. For now, it is staying below the 1.1902 level, and it’s pretty much likely to find support at the 1.1837 level. Violation of 1.1837 level can trigger selling trend until 1.1775 mark. Conversely, bullish trend continuation of 1.1901 level can lead EUR/USD towards 1.1945 level.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account