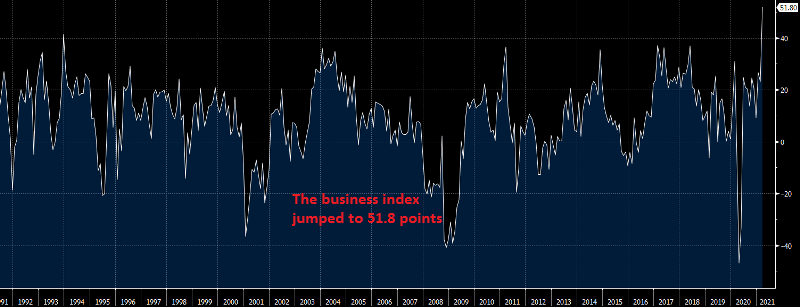

Philly FED Business Outlook Jumps to Best Levels Since 1973

The US economy keeps improving

•

Last updated: Thursday, March 18, 2021

The US philly FED manufacturing index dived to all time lows in spring last year, falling to -56.6 points in April, during the lockdowns. It started reversing in summer and it kept growing, as the manufacturing activity increased. But, this month we saw a major jump, which takes it to the best levels since 1973, as James Blunt would sing about.

US March Philly Fed Business Outlook

- March Philly Fed business outlook 51.8 points vs 23.3 expected

- Best reading since 1973

- February Philly Fed business outlook was 23.1 points

- Prices paid 75.9 vs 54.4 prior (highest since March 1980)

- New orders 50.9 vs 23.4 prior

- Employment 30.1 vs 25.3 prior

- Six month index 61.6 vs 39.5 prior

- 59% of firms reported increases in activity with only 7% reporting decreases

- Full report

Just look at that chart. These numbers blew away the consensus and anything over the past 30 years. US equity futures are lower but they highlight the economic tailwind that’s coming for the next few months.

US initial jobless claims and continuing claims

- Initial jobless claims 770K vs 700K estimate

- Prior week revised to 725K from 712K previously reported. Continuing claims was revised to 4142K

- versus 4144K previously reported

- Initial jobless claims 770K versus 700K estimate

- 4-week moving average initial jobless claims 746.25K versus a revised 762.25K last week

- Continuing claims 4124K vs 4034K estimate

- 4-week moving average continuing claims 4255K versus revised 4354K last week

- During the week ending February 27, 51 states reported 7,615,386 continued weekly claims for Pandemic Unemployment Assistance benefits and 51 states reported 4,815,348 continued claims for Pandemic Emergency Unemployment Compensation benefits.

- The largest increases in initial claims for the week ending March 6 were in California (+17,793), Ohio (+7,686), Massachusetts (+2,200), Alabama (+1,968), and Virginia (+1,581),

- The largest decreases were in New York (-11,906), Illinois (-10,628), Mississippi (-10,549), Texas (-6,932), and Kentucky (-4,580).

The data corresponds with the BLS survey week for the US jobs report which is to be released in the first week of April. ALthough higher than the estimate, it is lower than the month ago level of the 834K.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.