Gold Price Prediction: Sideways Trading Continues, Brace for Breakout!

The precious metal gold prices closed at 1732.50 after placing a high of 17554.20 and a low of 1716.60. Gold prices tried to break the

Written by:

Arslan Butt

•

Friday, March 19, 2021

•

2 min read

•

Last updated: Friday, March 19, 2021

The precious metal GOLD prices closed at 1732.50 after placing a high of 17554.20 and a low of 1716.60. Gold prices tried to break the bearish momentum on Thursday but failed to do so and continued their bullish streak for the third consecutive session. Prices were mixed on Thursday as they rose in the first half of the day and declined in the second half. The decline in the yellow metal was caused by the strength of the US dollar that was triggered by the recent hike in the US Treasury bond yields.

The 10-year US treasury note yield rose and reached its 13-month highest level above 1.7% on Thursday. The rising Treasury yields have been bad news for gold lately, and the investors were hopeful that Powell would give any hint of the Central Bank buying more bonds to cap the rising yields as they have been limiting the rally in risk assets. However, Fed Chair Jerome Powell declined to comment on the issue and added in the rising trend of yields that ultimately added further pressure on the yellow metal prices. Gold has been used as a hedge against inflation worries for about decades. Still, in recent months, the investors at Wall Street have been deliberately cautious and investing in Treasury yields and the US dollar instead of the precious metal against rising inflation worries.

On the other hand, the US dollar Index that tends to decline in heightened inflation fears was also rising in recent months. The greenback’s status as a reserve currency has encouraged its standing as a safe-haven and investors have started using it as a store of value that has pushed its price to 92 level. The strength of the US dollar kept the pressure intact on the prices of yellow metal on Thursday.

On the data front, at 17:30 GMT, the Philly Fed Manufacturing Index rose to 51.8 against the expected 22.5 and supported the US dollar, weighing on the yellow metal prices. The Unemployment Claims from the last week also rose to 770K against the expected 704K and weighed on the US dollar, capping further downward pressure on gold. At 19:00 GMT, the CB Leading Index declined to 0.2% against the forecast 0.3% and weighed on the US dollar and limited the losses in prices.Meanwhile, on Thursday, Fed Chair Jerome Powell said that the coronavirus pandemic had highlighted the need to advance systems for transferring money across international borders. The desire for improvement and digitalization has been accelerated for the less efficient areas of the current payment system after the coronavirus pandemic. Powell added that it has become crucial to integrate potential central bank digital currencies into the existing payment system alongside cash and other forms of money. He said that the pandemic crisis had underscored the limitation of current arrangements for cross-border payments and a need to add digital currencies to the system. Although the current money system was safe and reliable, it suffers from outdated technology.

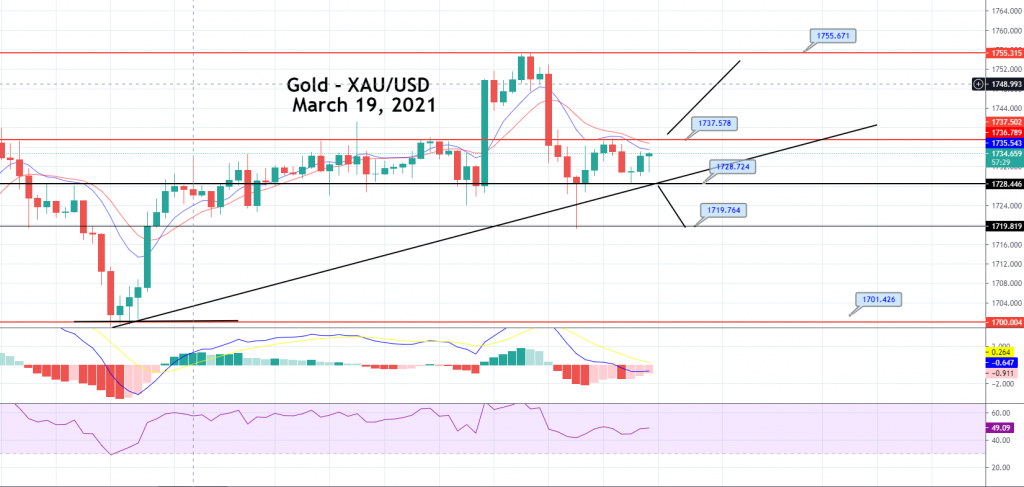

Daily Technical Levels

Support Resistance

1714.66 1752.26

1696.83 1772.03

1677.06 1789.86

Pivot point: 1734.43

GOLD is trading with a bearish bias, having dropped to $1,733 level. It is now gaining support around the 1,720 mark along with a resistance level of 1,740. The MACD and

RSI support a selling trend now, whereas the 20 & 50 periods EMA are also suggesting a selling bias. On the two-hourly timeframes, the precious metal is gaining support at 1,728 levels extended by an upward trendline. Gold can exhibit choppy trading within a trading range of 1,720 – 1,740 today. Good luck!

Arslan Butt

Lead Markets Analyst – Multi-Asset (FX, Commodities, Crypto)

Arslan Butt serves as the Lead Commodities and Indices Analyst, bringing a wealth of expertise to the field. With an MBA in Behavioral Finance and active progress towards a Ph.D., Arslan possesses a deep understanding of market dynamics.

His professional journey includes a significant role as a senior analyst at a leading brokerage firm, complementing his extensive experience as a market analyst and day trader. Adept in educating others, Arslan has a commendable track record as an instructor and public speaker.

His incisive analyses, particularly within the realms of cryptocurrency and forex markets, are showcased across esteemed financial publications such as ForexCrunch, InsideBitcoins, and EconomyWatch, solidifying his reputation in the financial community.

Related Articles