JPY Remains Weak, As BOJ Holds the Monetary Policy Unchanged

USD/JPY started to climb again after the BOJ left everything as it was

•

Last updated: Sunday, March 21, 2021

The JPY was bullish last year, attracting bids as the uncertainty remained high in financial markets, benefiting the safe haven currencies like the JPY and the CHF. But, this year the JPY turned bearish, sending USD/JPY surging higher, as most economies are expanding at a great pace.

USD/JPY increased around 9 cents from the bottom, but it has been consolidating around 109, finding support at the 50 SMA (yellow) on the H4 chart, waiting for the Bank of Japan meeting earlier today. The BOJ left the policy unchanged, so USD/JPY is resuming the bullish momentum again now.

BOJ Governor, Haruhiko Kuroda Press Conference

- It is appropriate to continue with current policy framework

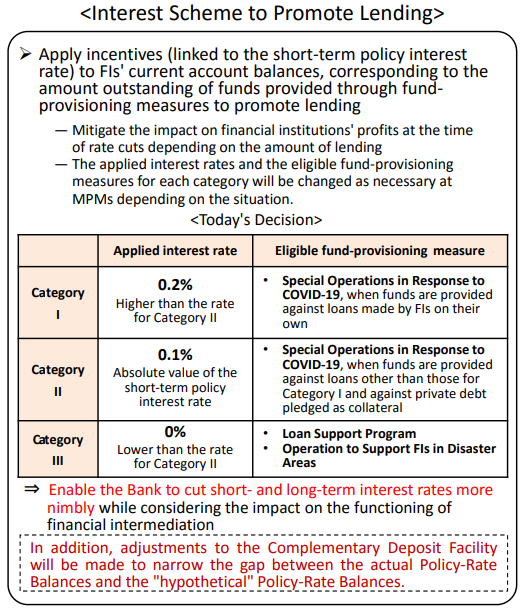

- New interest scheme to ease the impact of lowering rates further

- The rate levels on the scheme can be adjusted

- Priority is to keep entire yield curve low amid the virus crisis

- ETF purchases are effective in times of severe instability

- We did not expand the yields band with today’s decision

- BOJ simply clarified its view on the yields band

- Some yield fluctuations are positive for market function

- Does not intend to reduce ETF purchases or exit from stimulus policy

- ETF purchases are not undermining stock market function

- If we deepen negative rates, we will tweak interest based on the new scheme

- Not thinking about widening JGB yields band for now

- Too early to debate exit from stimulus policy

- BOJ chose to track Topix for ETF purchases to reduce impact on individual stocks

- Kuroda says that there is no contradiction with Amamiya’s comments (which suggested that the BOJ should expand the yields band) on yields. So, I guess we have the answer as to why Kuroda is making these comments.

It is interesting to see him lead with the introduction of the new interest scheme, which is pretty much him trying to imply that they are still on the dovish side of things.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.