Decisive Time for Crude Oil Between 2 MAs

Crude Oil retreated lower last week, but it's stuck between 2 daily MAs now

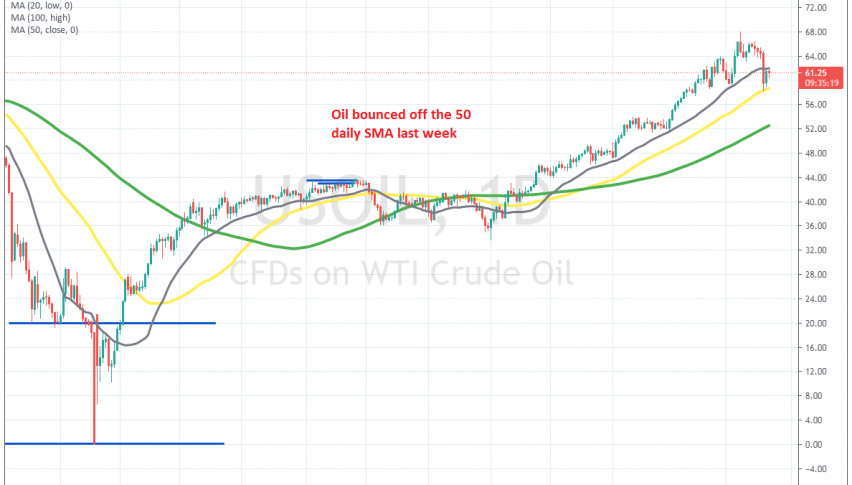

Crude Oil has been quite bullish for about a year since it reversed in April last year, following the coronavirus lockdown crash. US WTI reversed from the lowest price ever at around $-37 and has been climbing higher since then.

During the bullish move of the past year, moving averages were doing a great job in providing support during slight pullbacks, particularly the 20 SMA (gray) which kept pushing crude Oil higher. But on Thursday last week we saw a strong pullback, which took the price below the 20 SMA.

This moving average got broken on the daily chart, but the 50 SMA took its place and turned into support. US Oil bounced off that moving average on Thursday but the 20 SMA turned into resistance now. So, Oil traders are trying to make up their mind now.

There seems to be some kind of battle taking place between buyers and sellers here and whoever takes out the moving average first will win this battle. If sellers break the 20 SMA, then we might see a deeper pullback, probably down to $55 or $50, If buyers break the 50 SMA, then the bullish trend will resume again.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account