Earnings Keep Increasing in the UK

UK average earnings continue to surge despite restrictions

•

Last updated: Tuesday, March 23, 2021

Earnings used to be really strong in the UK in the previous years, despite Brexit. But, they turned negative in summer last year, as the economy tumbled due to the coronavirus restrictions. But, they started picking up and in December and January earnings have exceeded pre-pandemic levels.

UK February Employment and Earnings Report

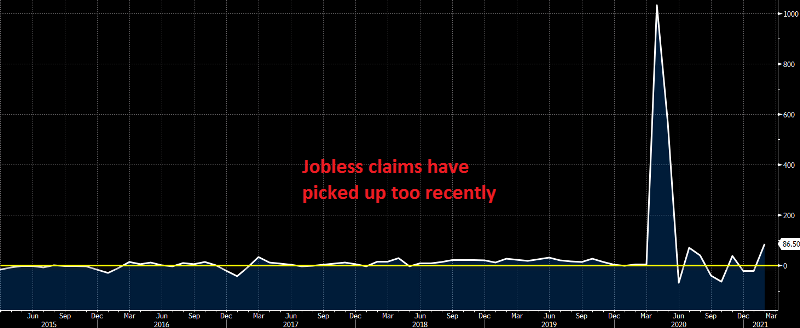

- February jobless claims change 86.5k vs -20.0k prior

- January jobless claims -20.0k; revised to -20.8k

- Claimant count rate 7.5%

- Prior claimant count rate was 7.2%

- January ILO unemployment rate 5.0% vs 5.2% expected

- December unemployment rate was 5.1%

- January employment change -147k vs -167k expected

- Prior employment change -114k

- January average weekly earnings +4.8% vs +4.9% 3m/y expected

- Prior weakly earnings +4.7%

- January average weekly earnings (ex bonus) +4.2% vs +4.4% 3m/y expected

- Prior excluding bonus +4.1%

Slight delay in the release by the source. The headline reading continues to be rather volatile as the furlough scheme distorts much of how to really read into the figures. The unemployment rate ticks a little lower while employment conditions reflected yet another drop to start the new year – ninth consecutive fall in the three months to January.

There’s a lot of caveats to the report here but the biggest is still that the furlough scheme is masking the underlying conditions in the labour market, making it tough to draw much conclusions from the mixed signals in the figures.

On wages, ONS notes that the average annual growth has continued to strengthen but keep in mind that the data is also somewhat distorted by a fall in lower-paid jobs as compared to pre-pandemic labour market conditions.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.