Higher Spanish and German CPI Figures, Indicate Higher Inflation Tomorrow in Europe

Inflation jumping higher again in March in the Europe

The Eurozone CPI (consumer price index) inflation turned negative in August last year, as the economy of the bloc fell into recession after the lock-downs and the restrictions. OIl prices were on the climb, but the recession in services helped keep inflation low until December.

In January we saw a sudden reversal, which seemed a bit strange since the economy contracted again in Q4 of 2020 and will probably contract again in Q1 of this year, which would mean another technical recession.

Yet, the CPI jumped higher from -0.3% to 0.9%, which is not justified for just one month, even with the increase in Oil prices. Eurozone inflation is expected to increase further tomorrow to 1.4% and today’s jump in Spanish and German inflation figures is confirming the expectations:

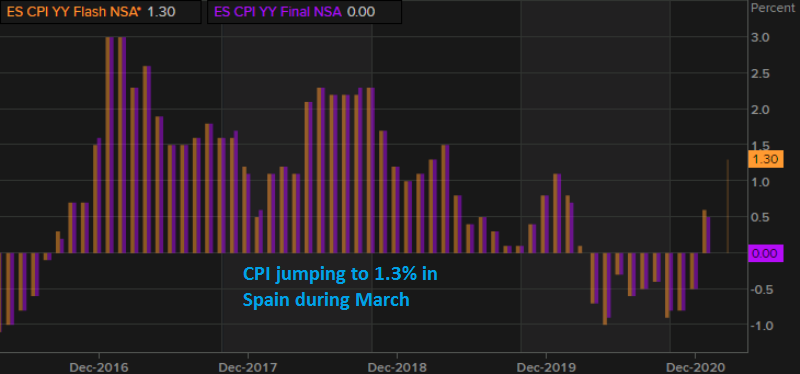

Spanish CPI Inflation Report

- March preliminary CPI YoY +1.3% vs +0.9% expected

- February CPI was 0.0%

- March HICP YoY +1.2% vs +0.9% expected

- February CPI was -0.1%

The wild swings in inflation numbers continue to play out for Spain, as base effect adjustments are also part of the picture and will stay the course for the year in all likelihood. Nonetheless, don’t expect the ECB to get all too jumpy by the bump higher in inflation figures that we are seeing so far on the day.

German Regional CPI Inflation Reports

- Bavaria March CPI YoY +1.8% vs +1.3% prior

- Prior CPI Y0Y was +1.3%

- Hesse CPI YoY +1.7%

- Prior CPI was +1.0%

- Brandenburg CPI YoY +2.0%

- Prior CPI was +1.4%

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account