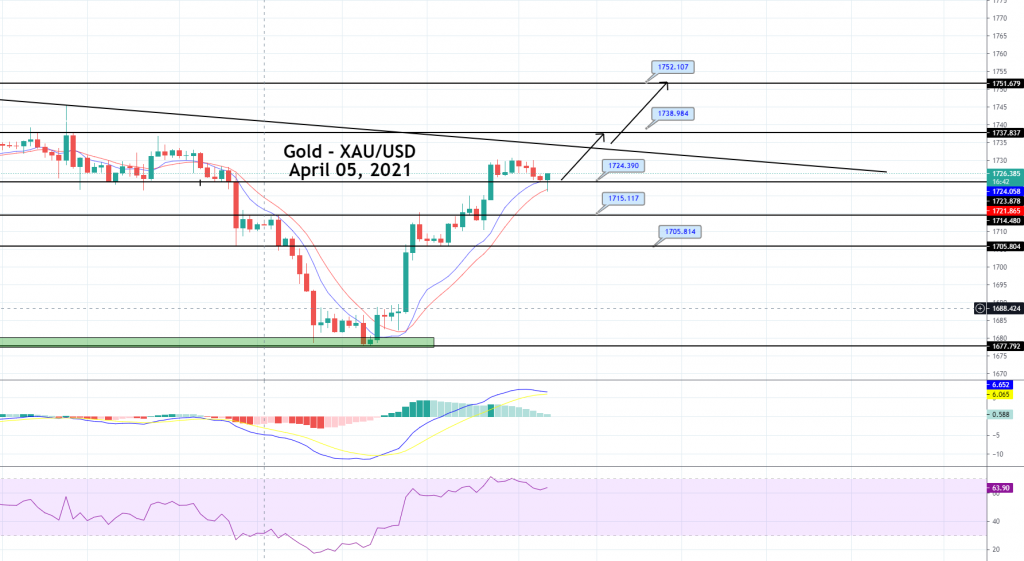

Gold Price Prediction: Choppy Session in Play, Bearish Bias Continues!

In light trading on Friday, the yellow metal remained under pressure due to the US dollar's rising strength after the data showed a rise in

Good morning, traders.

In light trading on Friday, the yellow metal remained under pressure due to the US dollar’s rising strength after the data showed a rise in the number of hired Americans in March. The US dollar and the yield of benchmark Treasury note rose and supported the hopes for a strong US economic recovery. Equity and financial markets were closed for Good Friday in the USA, Europe, and elsewhere; however, it was not a US government holiday, and hence, the Labor Department released its scheduled Non-Farm Payrolls report on Friday.

The Unemployment rate fell from previous month’s 6.2% to 6.0% in March, and the US economy added about 916K jobs in March that indicated a strong economic bounce in decades. This report strengthened the US dollar and exerted pressure on yellow metal prices. At 17:30 GMT, Average Hourly Earnings from the US for March declined to -0.1% against the projected 0.1% and weighed on the US dollar. In March, the Non-Farm Employment Change raised to 916K against the forecast 652K and supported the US dollar. The Unemployment Rate from the US remained flat with the expectations of 6.0%.

The US treasury yields on a 10-year note rose by 3.5 basis points to 1.7143%, and this was still below the week’s highest level of 1.77% that was its 14-months high level. The recent hike in treasury yields was caused by the optimism that surged after the announcement of US President Joe Biden’s $2.3 trillion infrastructure plan along with the extended rollout of coronavirus vaccines.The US dollar index also rose for the third consecutive week, and it is expected to continue its bullish momentum amid the strength in the labor market that will eventually weigh on the prices of the yellow metal. According to US Centers for Disease Control and Prevention, more than 4 million doses of coronavirus vaccine were reported to be administered in 24 hours on Saturday. This set a new record and brought the seven-day average to more than 3 million doses a day. It also strengthened the US dollar and imposed a negative impression on GOLD prices.

Support Resistance

1726.51 1731.96

1724.28 1735.18

1721.06 1737.41

Pivot Point: 1729.73On Monday, the precious metal has opened with a bearish gap on the back of stronger NFP figures. Gold is trading at 1,726 level, and it’s likely to gain support at 1,721 and 1,719 level along with a resistance level of 1,730. Chances of bearish bias remain strong today, significantly below 1,727 level. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account